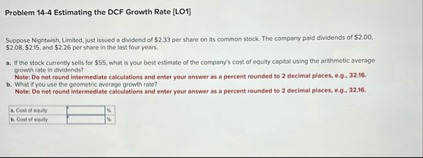

Question: Problem 1 4 - 4 Estimating the DCF Growth Rate [ LO 1 ] Suppose Nightwish. Limited, just issued a dividend of $ 2 .

Problem Estimating the DCF Growth Rate LO

Suppose Nightwish. Limited, just issued a dividend of $ per share on its common stock. The company paid dividends of $ $$ and $ per share in the last four years.

a If the stock curtently sells for $ what is your best estimate of the company's cost of equity capital using the arithmetic average growth rate in dividends?

b What if you use the geometric average growth rate?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock