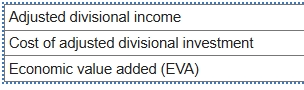

Question: Problem 1 4 - 6 0 ( Algo ) Economic Value Added ( LO 1 4 - 4 ) Normandy Instruments invests heavily in research

Step by Step Solution

There are 3 Steps involved in it

To compute the Economic Value Added EVA for Normandys Aerospace Division for year 2 follow these ste... View full answer

Get step-by-step solutions from verified subject matter experts