Question: Problem 1 4 . 8 1 2 . 5 points A company based in the United Kingdom has an Italian subsidiary. The subsidiary generates 2

Problem

points

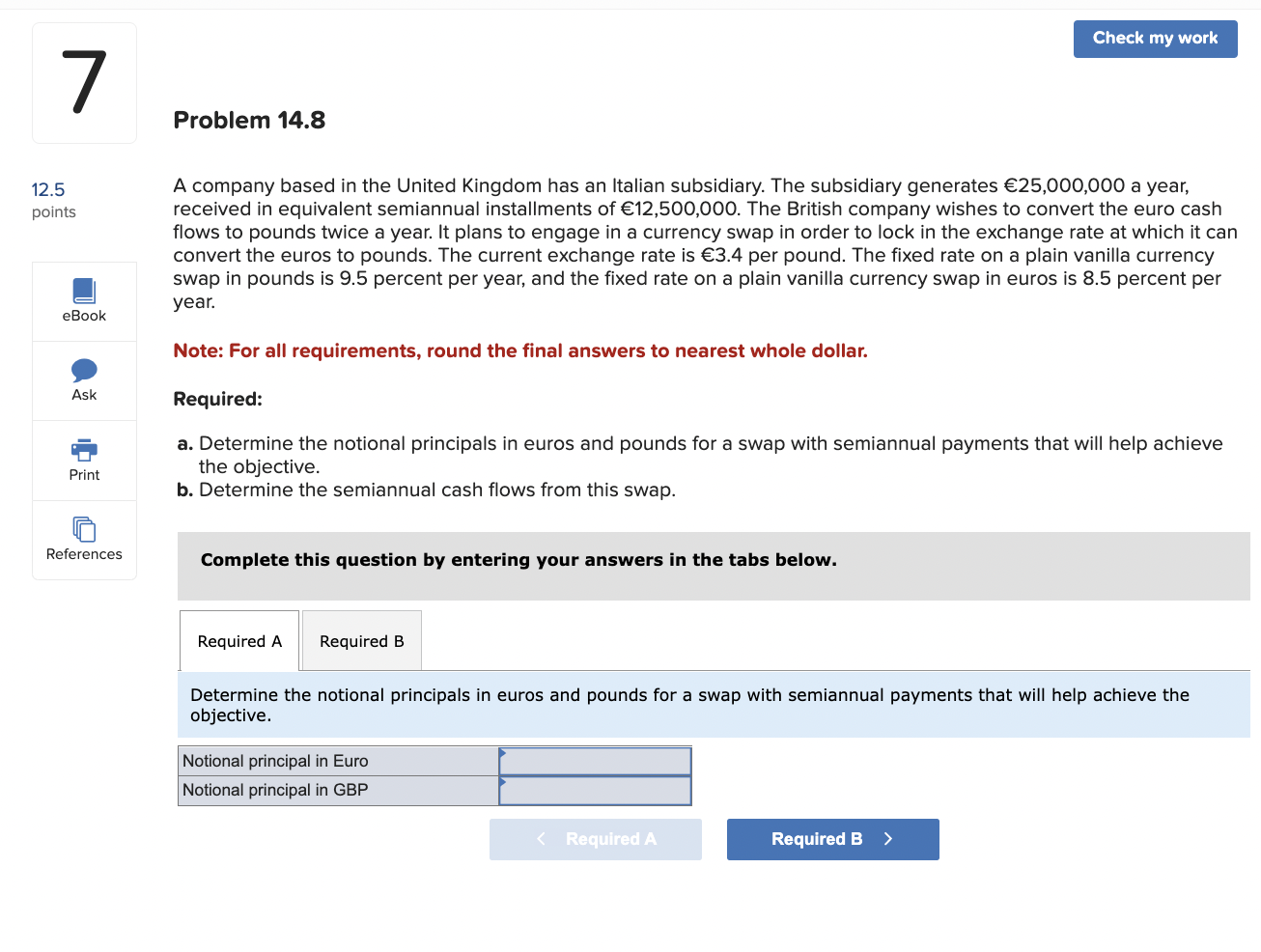

A company based in the United Kingdom has an Italian subsidiary. The subsidiary generates a year,

received in equivalent semiannual installments of The British company wishes to convert the euro cash

flows to pounds twice a year. It plans to engage in a currency swap in order to lock in the exchange rate at which it can

convert the euros to pounds. The current exchange rate is per pound. The fixed rate on a plain vanilla currency

swap in pounds is percent per year, and the fixed rate on a plain vanilla currency swap in euros is percent per

year.

Note: For all requirements, round the final answers to nearest whole dollar.

Required:

a Determine the notional principals in euros and pounds for a swap with semiannual payments that will help achieve

the objective.

b Determine the semiannual cash flows from this swap.

Complete this question by entering your answers in the tabs below.

Determine the notional principals in euros and pounds for a swap with semiannual payments that will help achieve the

objective.

Notional principal in Euro

Notional principal in GBP

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock