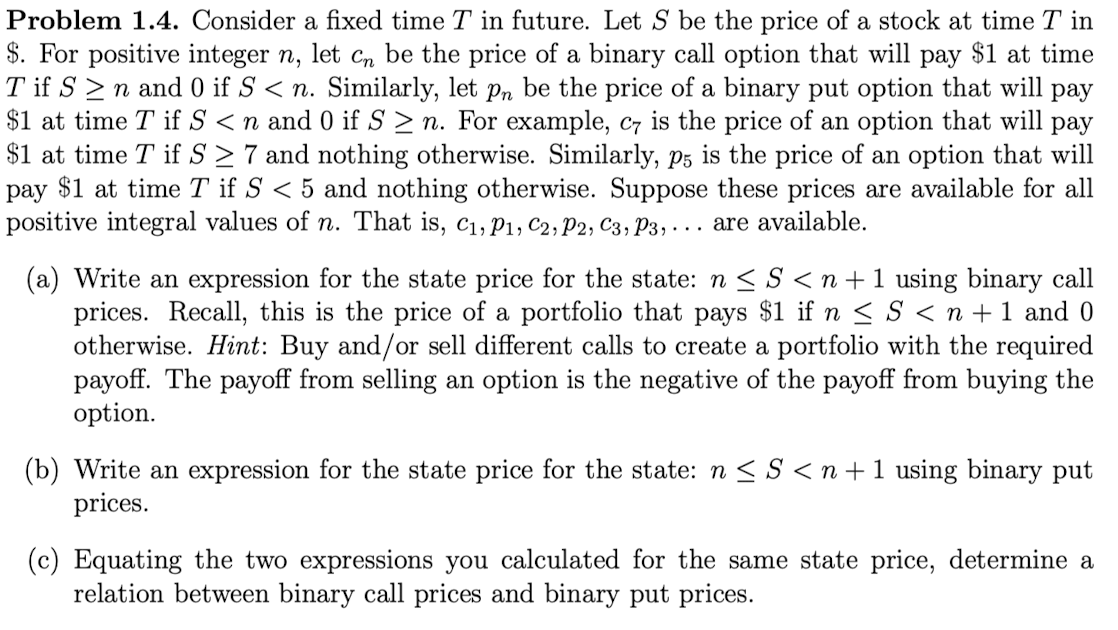

Question: Problem 1 . 4 . Consider a fixed time T in future. Let S be the price of a stock at time T in $

Problem Consider a fixed time in future. Let be the price of a stock at time in

$ For positive integer let be the price of a binary call option that will pay $ at time

if and if $$$dots$ using binary put

prices.

Equating the two expressions you calculated for the same state price, determine

relation between binary call prices and binary put prices. and

otherwise. Hint: Buy sell different calls create a portfolio with the required

payoff. The payoff from selling option the negative the payoff from buying the

option.

Write expression for the state price for the state: using binary put

prices.

Equating the two expressions you calculated for the same state price, determine

relation between binary call prices and binary put prices. using binary call

prices. Recall, this the price a portfolio that pays $ and

otherwise. Hint: Buy sell different calls create a portfolio with the required

payoff. The payoff from selling option the negative the payoff from buying the

option.

Write expression for the state price for the state: using binary put

prices.

Equating the two expressions you calculated for the same state price, determine

relation between binary call prices and binary put prices. and For example, the price option that will pay

$ time and nothing otherwise. Similarly, the price option that will

pay $ time and nothing otherwise. Suppose these prices are available for all

positive integral values That dots are available.

Write expression for the state price for the state: using binary call

prices. Recall, this the price a portfolio that pays $ and

otherwise. Hint: Buy sell different calls create a portfolio with the required

payoff. The payoff from selling option the negative the payoff from buying the

option.

Write expression for the state price for the state: using binary put

prices.

Equating the two expressions you calculated for the same state price, determine

relation between binary call prices and binary put prices. Similarly, let the price a binary put option that will pay

$ time and For example, the price option that will pay

$ time and nothing otherwise. Similarly, the price option that will

pay $ time and nothing otherwise. Suppose these prices are available for all

positive integral values That dots are available.

Write expression for the state price for the state: using binary call

prices. Recall, this the price a portfolio that pays $ and

otherwise. Hint: Buy sell different calls create a portfolio with the required

payoff. The payoff from selling option the negative the payoff from buying the

option.

Write expression for the state price for the state: using binary put

prices.

Equating the two expressions you calculated for the same state price, determine

relation between binary call prices and binary put prices.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock