Question: Problem 1 - 4 ( L . 3 . 3 ) Several years ago, Ethan purchased the former parsonage of St . James Church to

Problem L

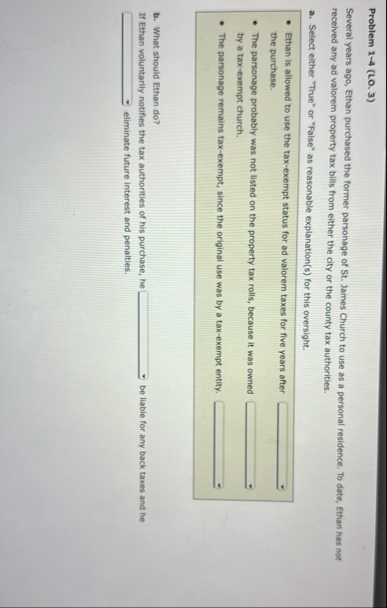

Several years ago, Ethan purchased the former parsonage of St James Church to use as a personal residence. To date, Ethan has not received any ad valorem property tax bills from either the city or the county tax authorities.

a Select either "True" or "False" as reasonable explanations for this oversight.

Ethan is allowed to use the taxexempt status for ad valorem taxes for five years after the purchase.

The parsonage probably was not listed on the property tax rolls, because it was owned by a taxexempt church.

The parsonage remains taxexempt, since the original use was by a taxexempt entity.

b What should Ethan do

If Ethan voluntarily notifies the tax authorities of his purchase, he be liable for any back taxes and he

eliminate future interest and penalties.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock