Question: Problem #1 (4 Marks) You have just purchased a share of a company for $20. The company is expected to pay a dividend of $.50

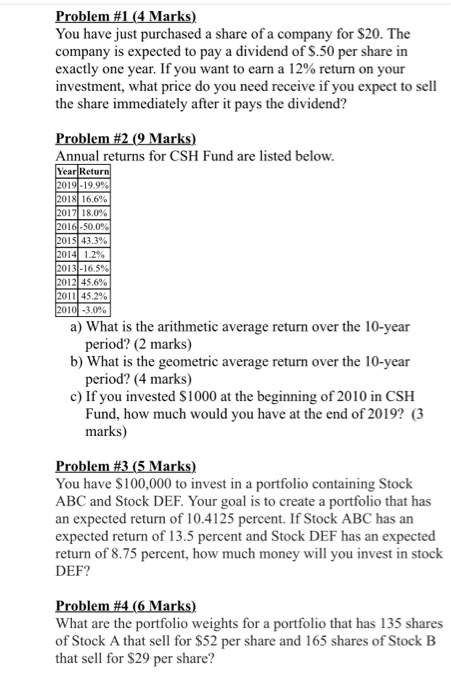

Problem #1 (4 Marks) You have just purchased a share of a company for $20. The company is expected to pay a dividend of $.50 per share in exactly one year. If you want to earn a 12% return on your investment, what price do you need receive if you expect to sell the share immediately after it pays the dividend? Problem #2 (9 Marks) Annual returns for CSH Fund are listed below. Year Return 2019 -19.9% 2018/ 16.6% 2017 18.0% 2016-50.0% 2015| 43.3% 2014 1.2% 2013.-16.5% 2012/ 45.6% 2011| 45.2% 2010 -3.0% a) What is the arithmetic average return over the 10-year period? (2 marks) b) What is the geometric average return over the 10-year period? (4 marks) c) If you invested $1000 at the beginning of 2010 in CSH Fund, how much would you have at the end of 2019? (3 marks) Problem #3 (5 Marks) You have $100,000 to invest in a portfolio containing Stock ABC and Stock DEF. Your goal is to create a portfolio that has an expected return of 10.4125 percent. If Stock ABC has an expected return of 13.5 percent and Stock DEF has an expected return of 8.75 percent, how much money will you invest in stock DEF? Problem #4 (6 Marks) What are the portfolio weights for a portfolio that has 135 shares of Stock A that sell for $52 per share and 165 shares of Stock B that sell for $29 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts