Question: Problem 1 4 On December 3 1 , 2 0 2 4 , Jacob sold a vacant lot to an unrelated individual for (

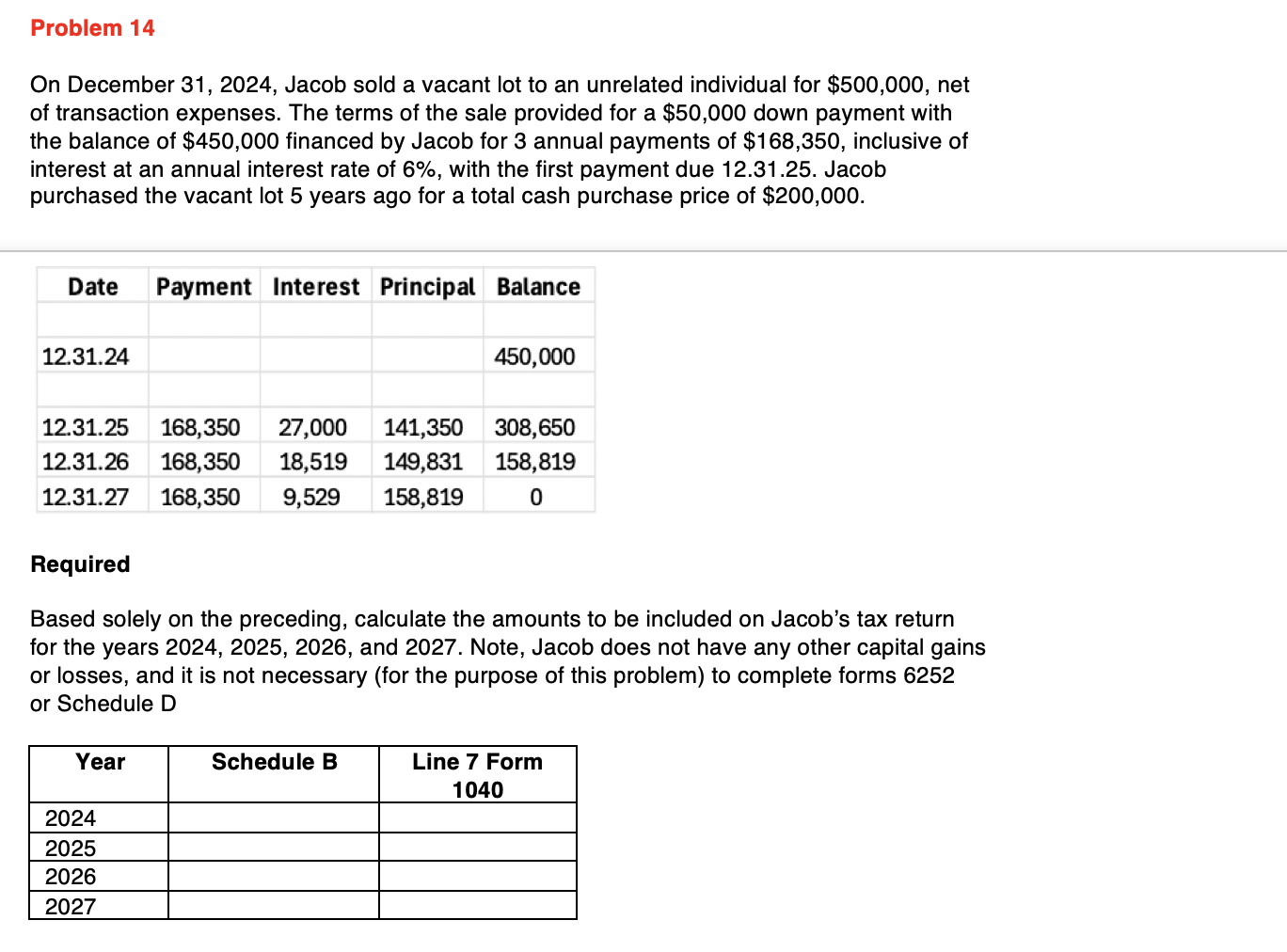

Problem On December Jacob sold a vacant lot to an unrelated individual for $ net of transaction expenses. The terms of the sale provided for a $ down payment with the balance of $ financed by Jacob for annual payments of $ inclusive of interest at an annual interest rate of with the first payment due Jacob purchased the vacant lot years ago for a total cash purchase price of $ Required Based solely on the preceding, calculate the amounts to be included on Jacob's tax return for the years and Note, Jacob does not have any other capital gains or losses, and it is not necessary for the purpose of this problem to complete forms or Schedule D

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock