Question: Problem 1 . 4 This is an application of the bootstrapping procedure discussed in class for determining the zero rates from bond prices. We are

Problem

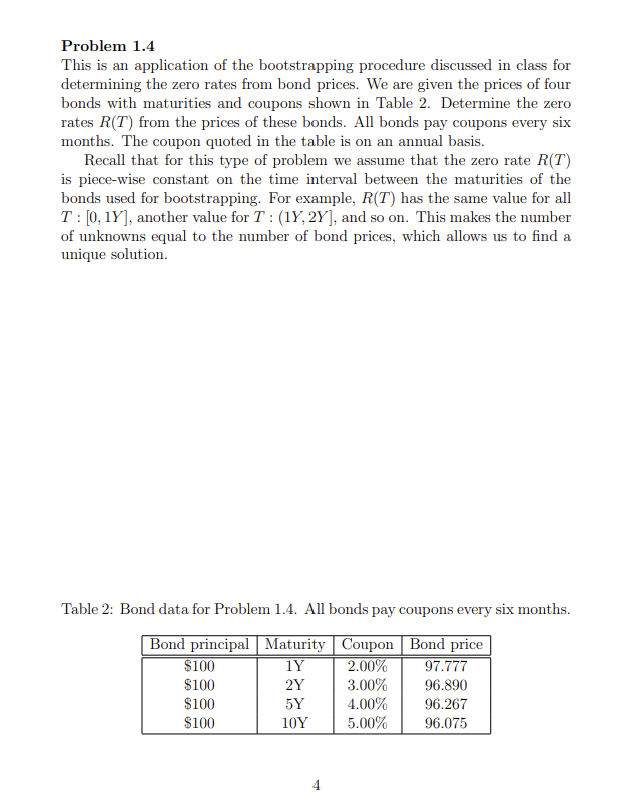

This is an application of the bootstrapping procedure discussed in class for

determining the zero rates from bond prices. We are given the prices of four

bonds with maturities and coupons shown in Table Determine the zero

rates from the prices of these bonds. All bonds pay coupons every six

months. The coupon quoted in the table is on an annual basis.

Recall that for this type of problem we assume that the zero rate

is piecewise constant on the time interval between the maturities of the

bonds used for bootstrapping. For example, has the same value for all

: another value for : and so on This makes the number

of unknowns equal to the number of bond prices, which allows us to find a

unique solution.

Table : Bond data for Problem All bonds pay coupons every six months.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock