Question: Problem 1 5 - 1 8 ( Algo ) Missing Data; Statement of Cash Flows [ LO 1 5 - 1 , LO 1 5

Problem Algo Missing Data; Statement of Cash Flows LO LO LO LO LO

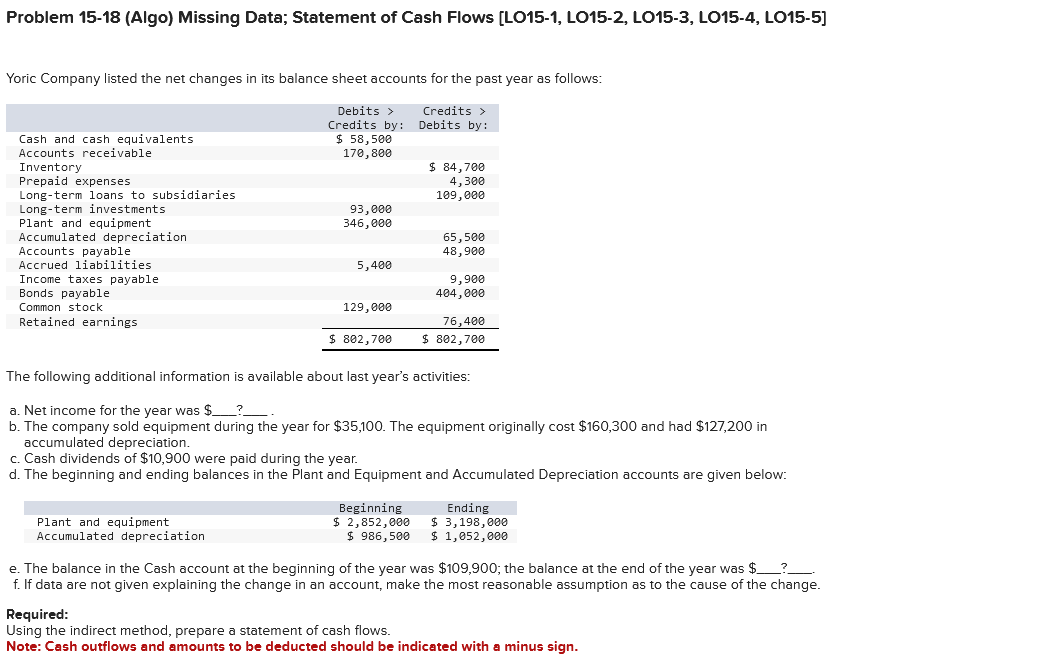

Yoric Company listed the net changes in its balance sheet accounts for the past year as follows:

Debits Credits by: Credits Debits by:

Cash and cash equivalents $

Accounts receivable

Inventory $

Prepaid expenses

Longterm loans to subsidiaries

Longterm investments

Plant and equipment

Accumulated depreciation

Accounts payable

Accrued liabilities

Income taxes payable

Bonds payable

Common stock

Retained earnings

$ $

The following additional information is available about last years activities:

Net income for the year was $blank?question markblank

The company sold equipment during the year for $ The equipment originally cost $ and had $ in accumulated depreciation.

Cash dividends of $ were paid during the year.

The beginning and ending balances in the Plant and Equipment and Accumulated Depreciation accounts are given below:

Beginning Ending

Plant and equipment $ $

Accumulated depreciation $ $

The balance in the Cash account at the beginning of the year was $; the balance at the end of the year was $blank?question markblank.

If data are not given explaining the change in an account, make the most reasonable assumption as to the cause of the change.

Required:

Using the indirect method, prepare a statement of cash flows.

Note: Cash outflows and amounts to be deducted should be indicated with a minus sign.Problem Algo Missing Data; Statement of Cash Flows LO LO LO LO LO

Yoric Company listed the net changes in its balance sheet accounts for the past year as follows:

The following additional information is available about last year's activities:

a Net income for the year was $

b The company sold equipment during the year for $ The equipment originally cost $ and had $ in

accumulated depreciation.

c Cash dividends of $ were paid during the year.

d The beginning and ending balances in the Plant and Equipment and Accumulated Depreciation accounts are given below:

e The balance in the Cash account at the beginning of the year was $; the balance at the end of the year was $

f If data are not given explaining the change in an account, make the most reasonable assumption as to the cause of the change.

Required:

Using the indirect method, prepare a statement of cash flows.

Note: Cash outflows and amounts to be deducted should be indicated with a minus sign.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock