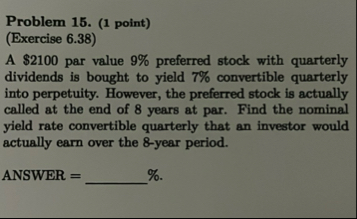

Question: Problem 1 5 . ( 1 point ) ( Exercise 6 . 3 8 ) A $ 2 1 0 0 par value 9 %

Problem point

Exercise

A $ par value preferred stock with quarterly dividends is bought to yield convertible quarterly into perpetuity. However, the preferred stock is actually called at the end of years at par. Find the nominal yield rate convertible quarterly that an investor would actually earn over the year period.

ANSWER

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock