Question: Problem 1 5 - 9 IPO Costs ( LO 2 ) When Microsoft went public, the company sold 3 million new shares ( the primary

Problem IPO Costs LO

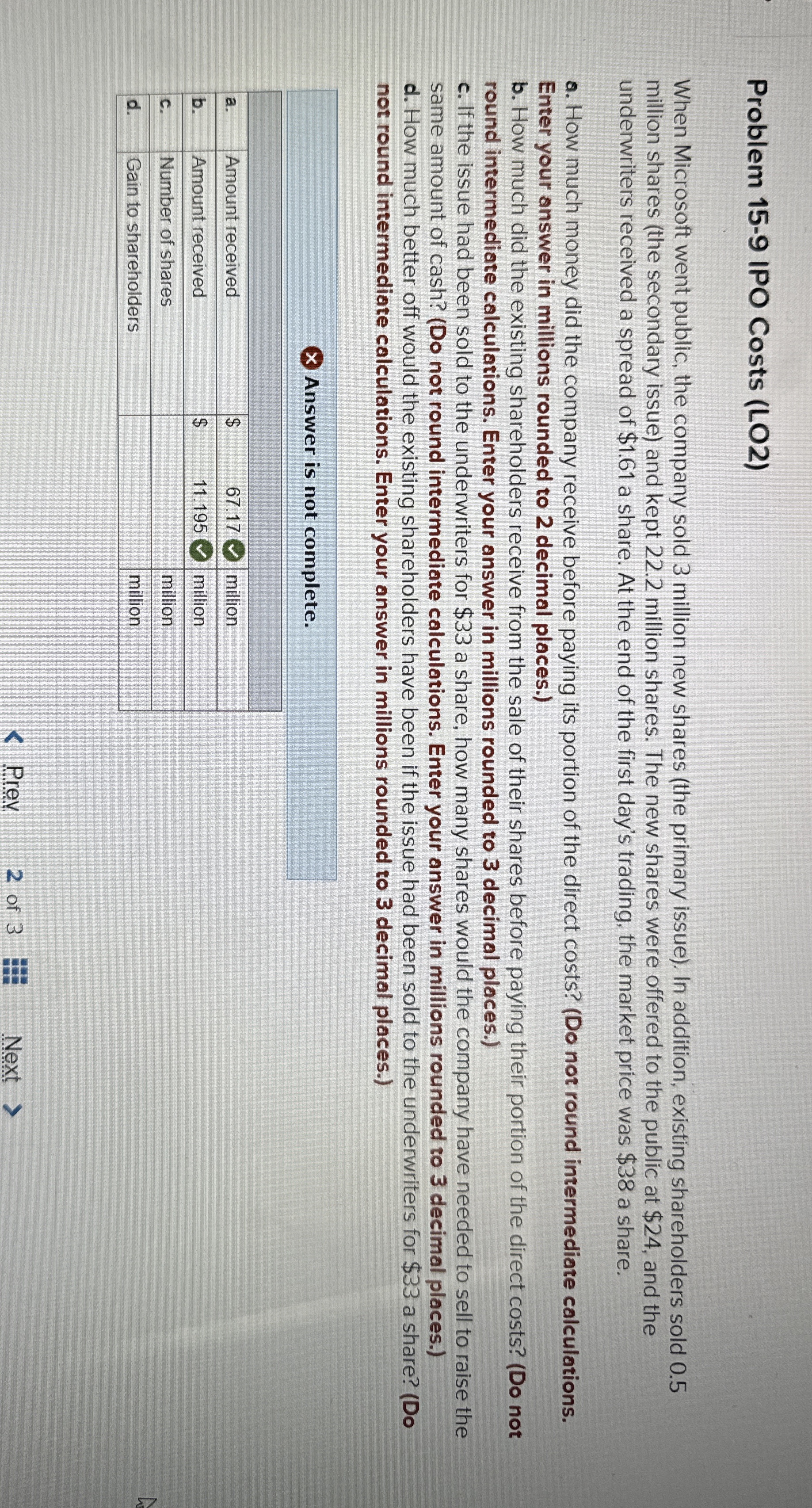

When Microsoft went public, the company sold million new shares the primary issue In addition, existing shareholders sold million shares the secondary issue and kept million shares. The new shares were offered to the public at $ and the underwriters received a spread of $ a share. At the end of the first day's trading, the market price was $ a share.

a How much money did the company receive before paying its portion of the direct costs? Do not round intermediate calculations. Enter your answer in millions rounded to decimal places.

b How much did the existing shareholders receive from the sale of their shares before paying their portion of the direct costs? Do not round intermediate calculations. Enter your answer in millions rounded to decimal places.

c If the issue had been sold to the underwriters for $ a share, how many shares would the company have needed to sell to raise the same amount of cash? Do not round intermediate calculations. Enter your answer in millions rounded to decimal places.

d How much better off would the existing shareholders have been if the issue had been sold to the underwriters for $ a share? Do not round intermediate calculations. Enter your answer in millions rounded to decimal places.

Answer is not complete.

tableaAmount received,$millionbAmount received,$millioncNumber of shares,,,milliondGain to shareholders,,,million

Prev

of

Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock