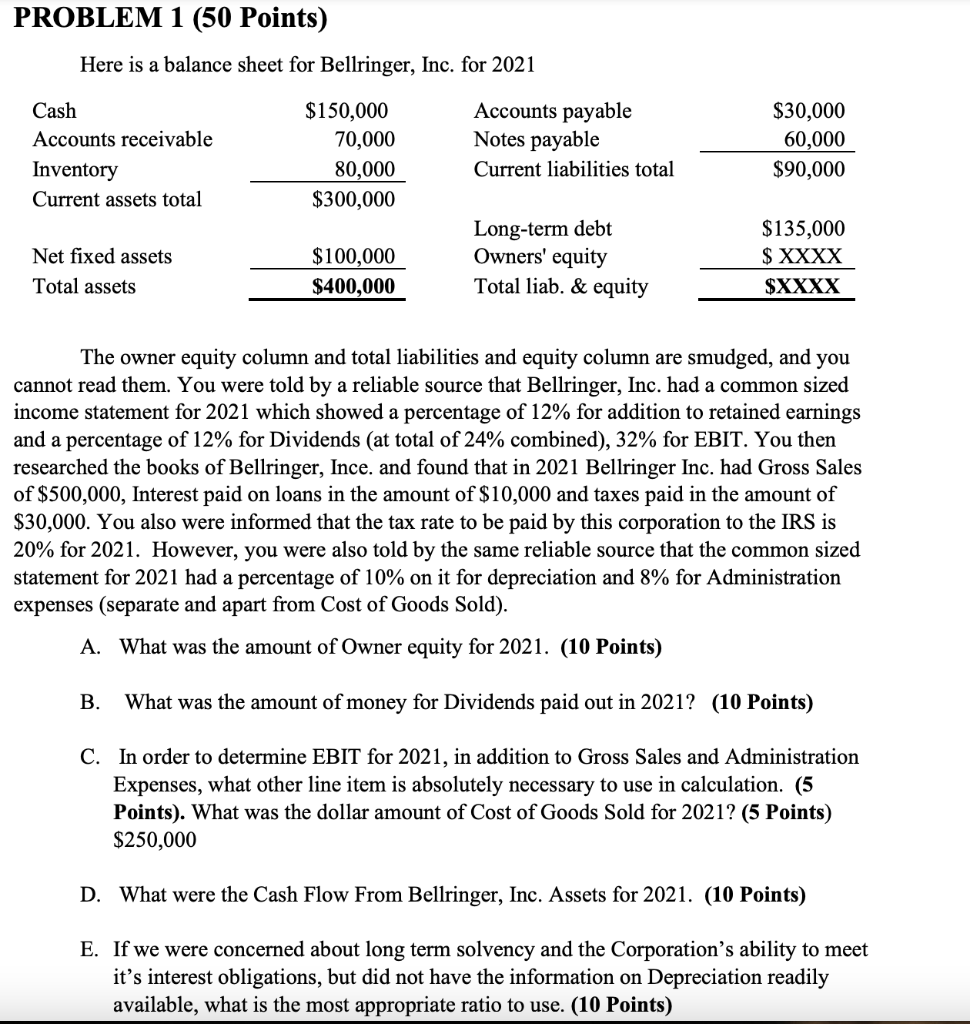

Question: PROBLEM 1 (50 Points) Here is a balance sheet for Bellringer, Inc. for 2021 The owner equity column and total liabilities and equity column are

PROBLEM 1 (50 Points) Here is a balance sheet for Bellringer, Inc. for 2021 The owner equity column and total liabilities and equity column are smudged, and you cannot read them. You were told by a reliable source that Bellringer, Inc. had a common sized income statement for 2021 which showed a percentage of 12% for addition to retained earnings and a percentage of 12% for Dividends (at total of 24% combined), 32% for EBIT. You then researched the books of Bellringer, Ince. and found that in 2021 Bellringer Inc. had Gross Sales of $500,000, Interest paid on loans in the amount of $10,000 and taxes paid in the amount of $30,000. You also were informed that the tax rate to be paid by this corporation to the IRS is 20% for 2021 . However, you were also told by the same reliable source that the common sized statement for 2021 had a percentage of 10% on it for depreciation and 8% for Administration expenses (separate and apart from Cost of Goods Sold). A. What was the amount of Owner equity for 2021. (10 Points) B. What was the amount of money for Dividends paid out in 2021? (10 Points) C. In order to determine EBIT for 2021, in addition to Gross Sales and Administration Expenses, what other line item is absolutely necessary to use in calculation. (5 Points). What was the dollar amount of Cost of Goods Sold for 2021? (5 Points) $250,000 D. What were the Cash Flow From Bellringer, Inc. Assets for 2021. (10 Points) E. If we were concerned about long term solvency and the Corporation's ability to meet it's interest obligations, but did not have the information on Depreciation readily available, what is the most appropriate ratio to use. (10 Points) PROBLEM 1 (50 Points) Here is a balance sheet for Bellringer, Inc. for 2021 The owner equity column and total liabilities and equity column are smudged, and you cannot read them. You were told by a reliable source that Bellringer, Inc. had a common sized income statement for 2021 which showed a percentage of 12% for addition to retained earnings and a percentage of 12% for Dividends (at total of 24% combined), 32% for EBIT. You then researched the books of Bellringer, Ince. and found that in 2021 Bellringer Inc. had Gross Sales of $500,000, Interest paid on loans in the amount of $10,000 and taxes paid in the amount of $30,000. You also were informed that the tax rate to be paid by this corporation to the IRS is 20% for 2021 . However, you were also told by the same reliable source that the common sized statement for 2021 had a percentage of 10% on it for depreciation and 8% for Administration expenses (separate and apart from Cost of Goods Sold). A. What was the amount of Owner equity for 2021. (10 Points) B. What was the amount of money for Dividends paid out in 2021? (10 Points) C. In order to determine EBIT for 2021, in addition to Gross Sales and Administration Expenses, what other line item is absolutely necessary to use in calculation. (5 Points). What was the dollar amount of Cost of Goods Sold for 2021? (5 Points) $250,000 D. What were the Cash Flow From Bellringer, Inc. Assets for 2021. (10 Points) E. If we were concerned about long term solvency and the Corporation's ability to meet it's interest obligations, but did not have the information on Depreciation readily available, what is the most appropriate ratio to use. (10 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts