Question: Problem 1: 50 points show your work to the right of the questions; list the inputs that you use. Dominion Resources (D) has just paid

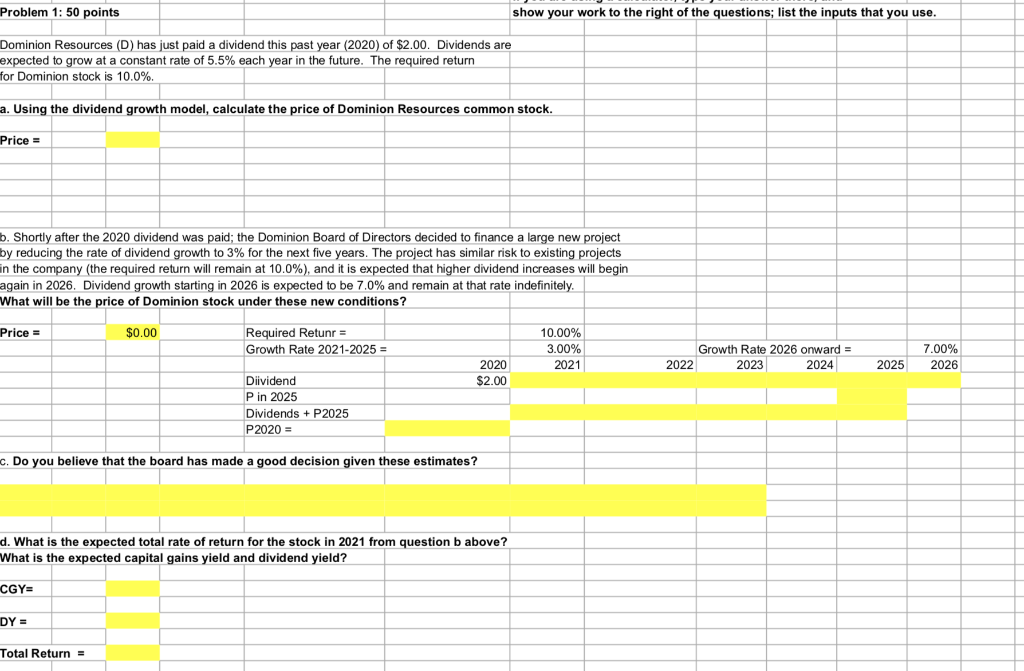

Problem 1: 50 points show your work to the right of the questions; list the inputs that you use. Dominion Resources (D) has just paid a dividend this past year (2020) of $2.00. Dividends are expected to grow at a constant rate of 5.5% each year in the future. The required return for Dominion stock is 10.0%. a. Using the dividend growth model, calculate the price of Dominion Resources common stock. Price = b. Shortly after the 2020 dividend was paid; the Dominion Board of Directors decided to finance a large new project by reducing the rate of dividend growth to 3% for the next five years. The project has similar risk to existing projects in the company (the required return will remain at 10.0%), and it is expected that higher dividend increases will begin again in 2026. Dividend growth starting in 2026 is expected to be 7.0% and remain at that rate indefinitely. What will be the price of Dominion stock under these new conditions ? Price = $0.00 Required Retunr = Growth Rate 2021-2025 = 10.00% 3.00% 2021 Growth Rate 2026 onward = 2022 2023 2024 7.00% 2026 2025 2020 $2.00 Diividend P in 2025 Dividends + P2025 P2020 = c. Do you believe that the board has made a good decision given these estimates? d. What is the expected total rate of return for the stock in 2021 from question b above? What is the expected capital gains yield and dividend yield? CGY DY = Total Return =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts