Question: Problem 1 6 - 1 1 You are considering the purchase of a convertible bond issued by Bildon Enterprises, a non - investment - grade

Problem

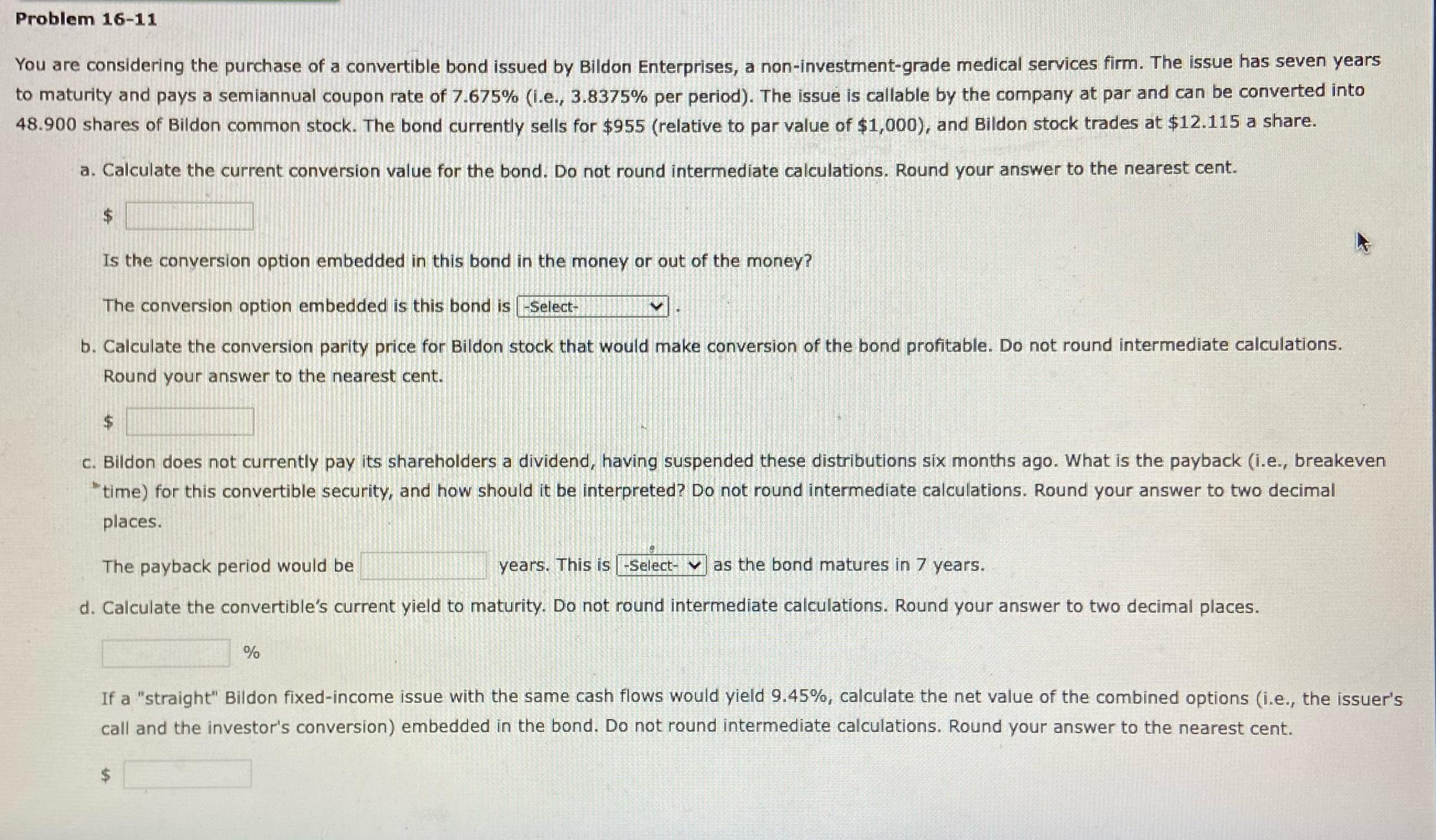

You are considering the purchase of a convertible bond issued by Bildon Enterprises, a noninvestmentgrade medical services firm. The issue has seven years to maturity and pays a semiannual coupon rate of ie per period The issue is callable by the company at par and can be converted into shares of Bildon common stock. The bond currently sells for $relative to par value of $ and Bildon stock trades at $ a share.

a Calculate the current conversion value for the bond. Do not round intermediate calculations. Round your answer to the nearest cent.

$

Is the conversion option embedded in this bond in the money or out of the money?

The conversion option embedded is this bond is

b Calculate the conversion parity price for Bildon stock that would make conversion of the bond profitable. Do not round intermediate calculations. Round your answer to the nearest cent.

$

c Bildon does not currently pay its shareholders a dividend, having suspended these distributions six months ago. What is the payback ie breakeven "time for this convertible security, and how should it be interpreted? Do not round intermediate calculations. Round your answer to two decimal places.

The payback period would be years. This is Select as the bond matures in years.

d Calculate the convertible's current yield to maturity. Do not round intermediate calculations. Round your answer to two decimal places.

If a "straight" Bildon fixedincome issue with the same cash flows would yield calculate the net value of the combined options ie the issuer's call and the investor's conversion embedded in the bond. Do not round intermediate calculations. Round your answer to the nearest cent.

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock