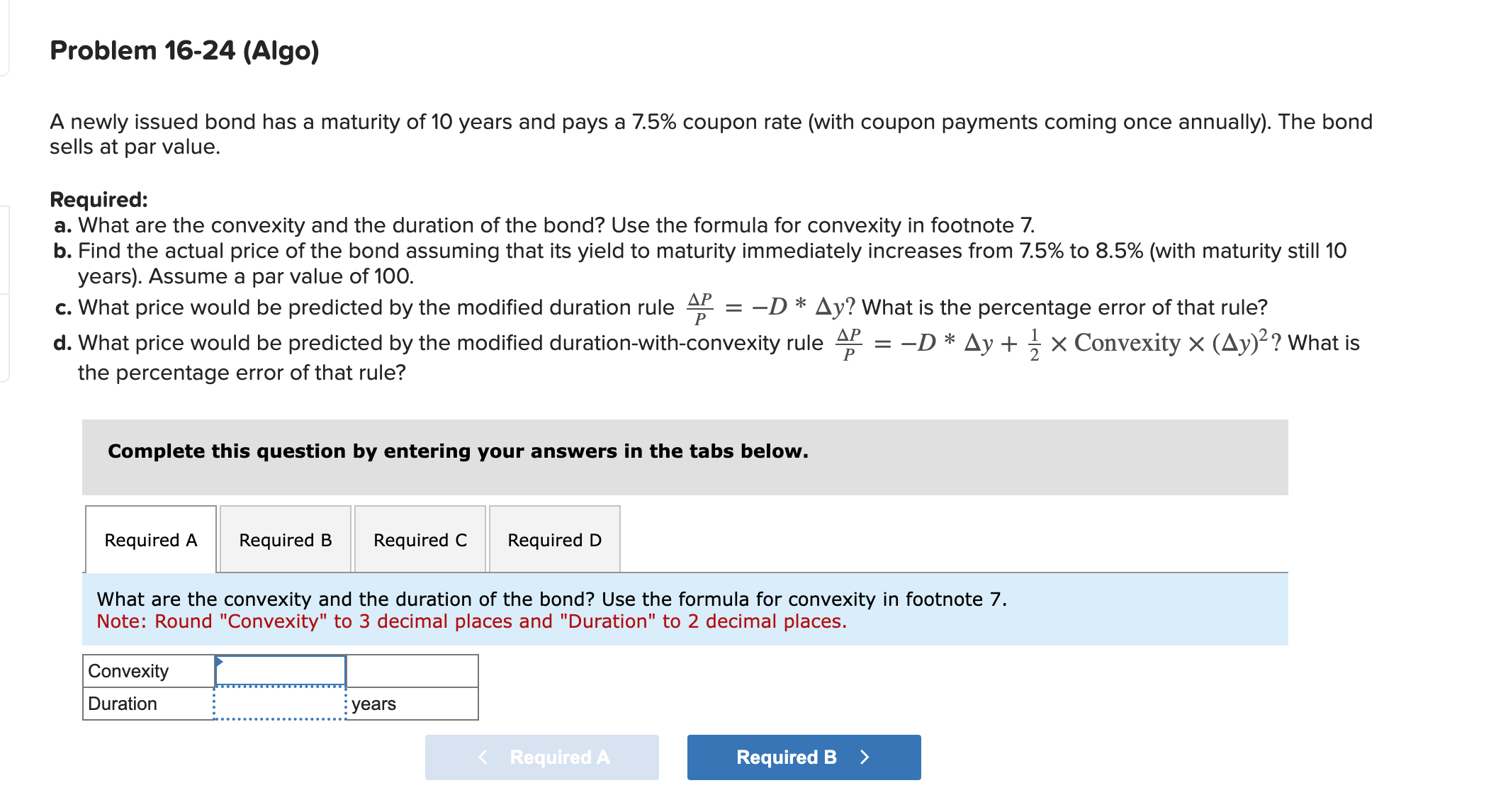

Question: Problem 1 6 - 2 4 ( Algo ) A newly issued bond has a maturity of 1 0 years and pays a 7 .

Problem Algo

A newly issued bond has a maturity of years and pays a coupon rate with coupon payments coming once annually The bond

sells at par value.

Required:

a What are the convexity and the duration of the bond? Use the formula for convexity in footnote

b Find the actual price of the bond assuming that its yield to maturity immediately increases from to with maturity still

years Assume a par value of

c What price would be predicted by the modified duration rule What is the percentage error of that rule?

d What price would be predicted by the modified durationwithconvexity rule Convexity What is

the percentage error of that rule?

Complete this question by entering your answers in the tabs below.

Required B

What are the convexity and the duration of the bond? Use the formula for convexity in footnote

Note: Round "Convexity" to decimal places and "Duration" to decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock