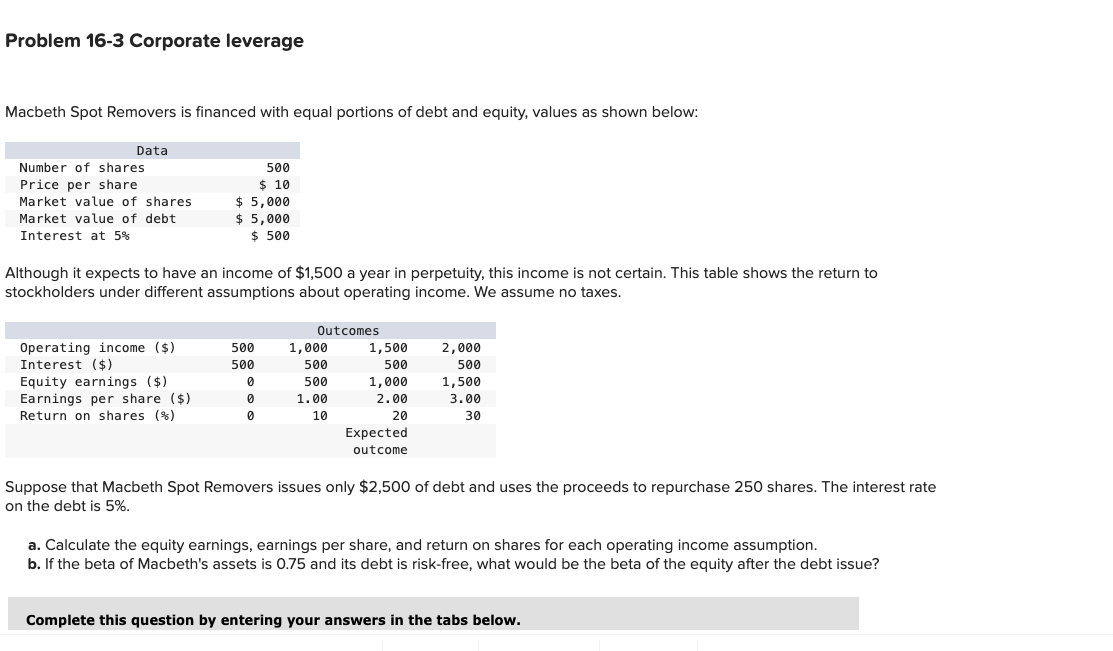

Question: Problem 1 6 - 3 Corporate leverage Macbeth Spot Removers is financed with equal portions of debt and equity, values as shown below: Although it

Problem Corporate leverage Macbeth Spot Removers is financed with equal portions of debt and equity, values as shown below: Although it expects to have an income of $ a year in perpetuity, this income is not certain. This table shows the return to stockholders under different assumptions about operating income. We assume no taxes. Suppose that Macbeth Spot Removers issues only $ of debt and uses the proceeds to repurchase shares. The interest rate on the debt is a Calculate the equity earnings, earnings per share, and return on shares for each operating income assumption. b If the beta of Macbeth's assets is and its debt is riskfree, what would be the beta of the equity after the debt issue? Complete this question by entering your answers in the tabs below.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock