Question: Problem 1 6 - 6 MM proposition 1 Executive Cheese has issued debt with a market value of ( $ 1 0 0

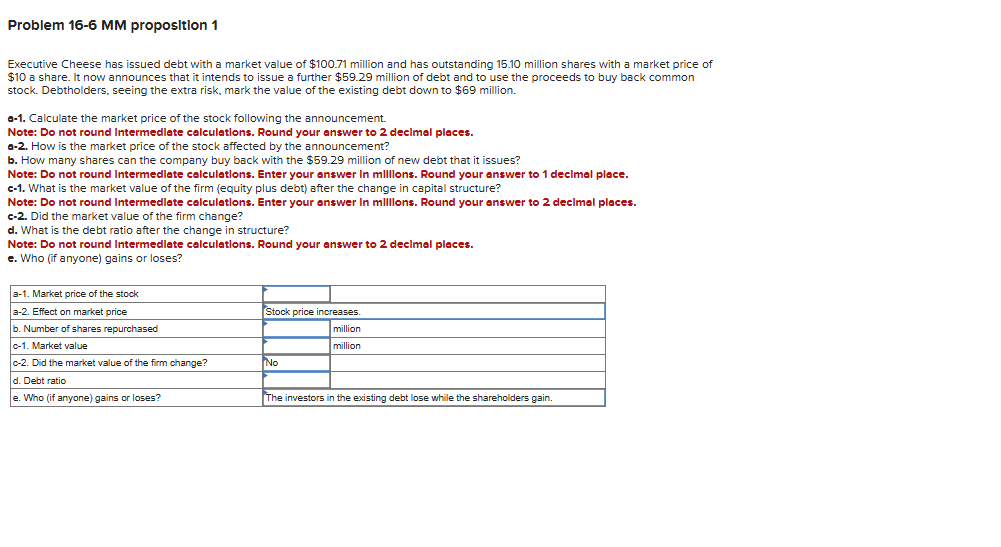

Problem MM proposition Executive Cheese has issued debt with a market value of $ million and has outstanding million shares with a market price of $ a share. It now announces that it intends to issue a further $ million of debt and to use the proceeds to buy back common stock. Debtholders, seeing the extra risk, mark the value of the existing debt down to $ million. a Calculate the market price of the stock following the announcement. Note: Do not round Intermedlate calculatlons. Round your answer to mathbf decimal places. How is the market price of the stock affected by the announcement? b How many shares can the company buy back with the $ million of new debt that it issues? Note: Do not round Intermedlate calculations. Enter your answer In millions. Round your answer to decimal place. c What is the market value of the firm equity plus debt after the change in capital structure? Note: Do not round Intermedlate calculations. Enter your answer In millions. Round your answer to mathbf decimal places. mathbfc Did the market value of the firm change? d What is the debt ratio after the change in structure? Note: Do not round Intermedlate calculatlons. Round your answer to mathbf decimal places. e Who if anyone gains or loses?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock