Question: Problem 1 6 - 7 ( Algo ) Multiple differences; calculate taxable income; balance sheet classification; financial statement effects [ LO 1 6 - 2

Problem Algo Multiple differences; calculate taxable income; balance sheet classification; financial statement effects LO

Sherrod, Incorporated, reported pretax accounting income of $ million for The following information relates to differences between pretax accounting income and taxable income:

Income from installment sales of properties included in pretax accounting income in exceeded that reported for tax purposes by $ million. The installment receivable account at yearend had a balance of $ million representing Problem Algo Determine deferred tax assets and liabilities from booktax differences; financial statement effects LO

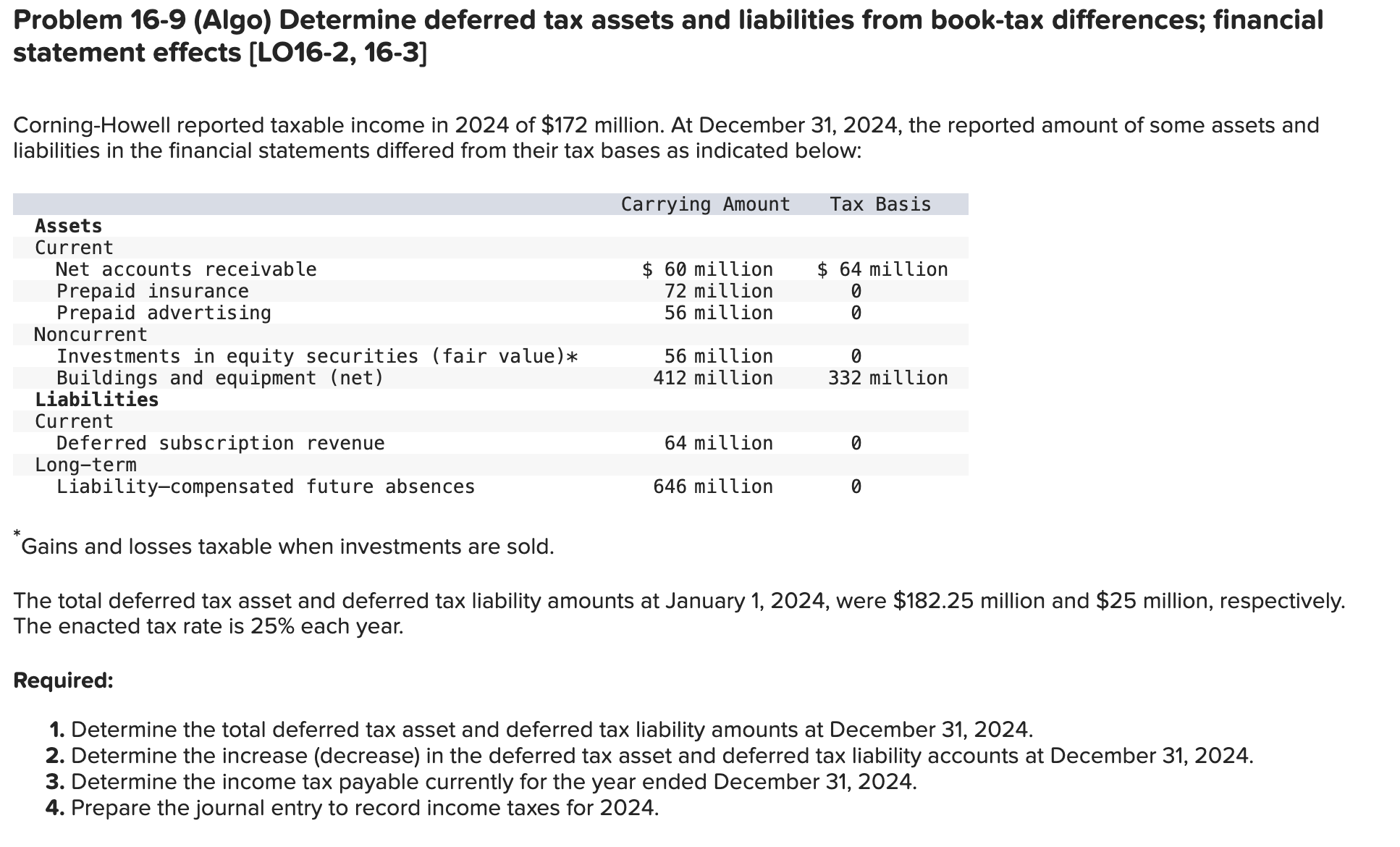

CorningHowell reported taxable income in of $ million. At December the reported amount of some assets and liabilities in the financial statements differed from their tax bases as indicated below:

Carrying AmountTax BasisAssetsCurrentNet accounts receivable$ million$ millionPrepaid insurancemillionPrepaid advertisingmillionNoncurrentInvestments in equity securities fair valueFootnote asteriskmillionBuildings and equipment netmillionmillionLiabilitiesCurrentDeferred subscription revenuemillionLongtermLiabilitycompensated future absencesmillion

Footnote asteriskGains and losses taxable when investments are sold.

The total deferred tax asset and deferred tax liability amounts at January were $ million and $ million, respectively. The enacted tax rate is each year.

Required:

Determine the total deferred tax asset and deferred tax liability amounts at December

Determine the increase decrease in the deferred tax asset and deferred tax liability accounts at December

Determine the income tax payable currently for the year ended December

Prepare the journal entry to record income taxes for Problem Algo Determine deferred tax assets and liabilities from booktax differences; financial statement effects LO

CorningHowell reported taxable income in of $ million. At December the reported amount of some assets and liabilities in the financial statements differed from their tax bases as indicated below:

begintabularccc

hline & multirowtCarrying Amount & Tax Basis

hline multicolumnlAssets &

hline multicolumnlCurrent

hline Net accounts receivable & $ million & $ million

hline Prepaid insurance & million &

hline Prepaid advertising & million &

hline multicolumnlNoncurrent

hline Investments in equity securities fair value & million &

hline Buildings and equipment net & million & million

hline multicolumnlLiabilities

hline multicolumnlCurrent

hline Deferred subscription revenue & million &

hline Longterm & &

hline Liabilitycompensated future absences & million &

hline

endtabular

Gains and losses taxable when investments are sold.

The total deferred tax asset and deferred tax liability amounts at January were $ million and $ million, respectively. The enacted tax rate is each year.

Required:

Determine the total deferred tax asset and deferred tax liability amounts at December

Determine the increase decrease in the deferred tax asset and deferred tax liability accounts at December

Determine the income tax payable currently for the year ended December

Prepare the journal entry to record income taxes for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock