Question: Problem 1 6 marks) In the text, the authors have broken the financial markets into money markets and capital markets. a) Briefly define each of

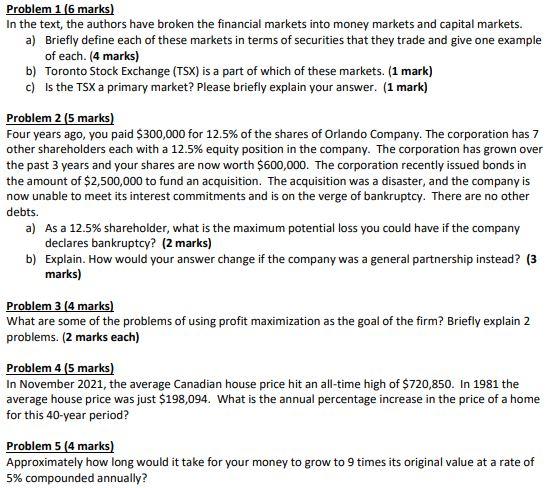

Problem 1 6 marks) In the text, the authors have broken the financial markets into money markets and capital markets. a) Briefly define each of these markets in terms of securities that they trade and give one example of each. (4 marks) b) Toronto Stock Exchange (TSX) is a part of which of these markets. (1 mark) c) Is the TSX a primary market? Please briefly explain your answer. (1 mark) Problem 2 (5 marks) Four years ago, you paid $300,000 for 12.5% of the shares of Orlando Company. The corporation has 7 other shareholders each with a 12.5% equity position in the company. The corporation has grown over the past 3 years and your shares are now worth $600,000. The corporation recently issued bonds in the amount of $2,500,000 to fund an acquisition. The acquisition was a disaster, and the company is now unable to meet its interest commitments and is on the verge of bankruptcy. There are no other debts. a) As a 12.5% shareholder, what is the maximum potential loss you could have if the company declares bankruptcy? (2 marks) b) Explain. How would your answer change if the company was a general partnership instead? (3 marks) Problem 3 (4 marks) What are some of the problems of using profit maximization as the goal of the firm? Briefly explain 2 problems. (2 marks each) Problem 4(5 marks) In November 2021, the average Canadian house price hit an all-time high of $720,850. In 1981 the average house price was just $198,094. What is the annual percentage increase in the price of a home for this 40-year period? Problem 5 (4 marks) Approximately how long would it take for your money to grow to 9 times its original value at a rate of 5% compounded annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts