Question: Problem 1 (6 Points) ABC Co. has acquired various types of assets recently. Below is a list of assets acquired between 2020 and 2023. ABC

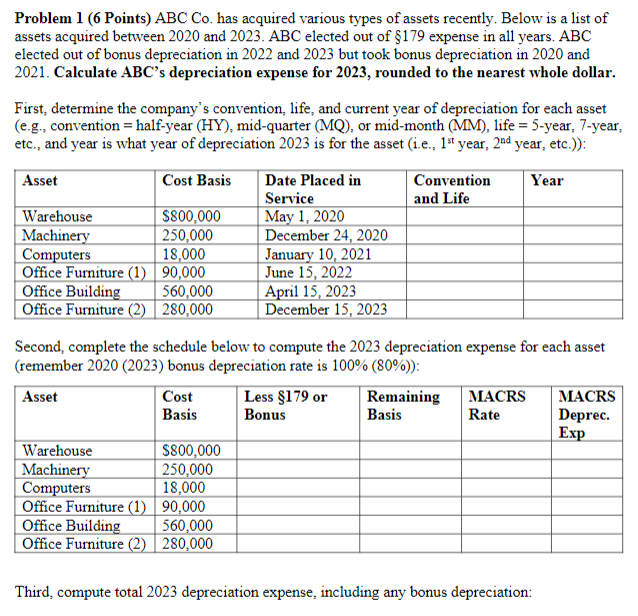

Problem 1 (6 Points) ABC Co. has acquired various types of assets recently. Below is a list of assets acquired between 2020 and 2023. ABC elected out of $179 expense in all years. ABC elected out of bonus depreciation in 2022 and 2023 but took bonus depreciation in 2020 and 2021. Calculate ABC's depreciation expense for 2023, rounded to the nearest whole dollar. First, determine the company's convention, life, and current year of depreciation for each asset (e.g., convention = half-year (HY), mid-quarter (MQ), or mid-month (MM), life = 5-year, 7-year, etc., and year is what year of depreciation 2023 is for the asset (i.e., 1ts year, 2nd year, etc.)): Second, complete the schedule below to compute the 2023 depreciation expense for each asset (remember 2020 (2023) bonus depreciation rate is 100\% (80\%)): Third, compute total 2023 depreciation expense, including any bonus depreciation: Problem 1 (6 Points) ABC Co. has acquired various types of assets recently. Below is a list of assets acquired between 2020 and 2023. ABC elected out of $179 expense in all years. ABC elected out of bonus depreciation in 2022 and 2023 but took bonus depreciation in 2020 and 2021. Calculate ABC's depreciation expense for 2023, rounded to the nearest whole dollar. First, determine the company's convention, life, and current year of depreciation for each asset (e.g., convention = half-year (HY), mid-quarter (MQ), or mid-month (MM), life = 5-year, 7-year, etc., and year is what year of depreciation 2023 is for the asset (i.e., 1ts year, 2nd year, etc.)): Second, complete the schedule below to compute the 2023 depreciation expense for each asset (remember 2020 (2023) bonus depreciation rate is 100\% (80\%)): Third, compute total 2023 depreciation expense, including any bonus depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts