Question: Problem #1 (6 points) Let's pretend I am back in my Kraft Food days as a young Engineer (young - quite a few years ago

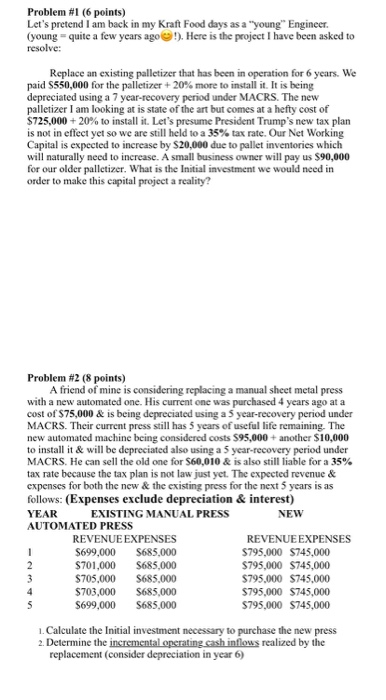

Problem #1 (6 points) Let's pretend I am back in my Kraft Food days as a "young Engineer (young - quite a few years ago !). Here is the project I have been asked to resolve: Replace an existing palletizer that has been in operation for 6 years. We paid $550,000 for the palletizer + 20% more to install it. It is being depreciated using a 7 year-recovery period under MACRS. The new palletizer I am looking at is state of the art but comes at a hefty cost of $725,000+ 20% to install it. Let's presume President Trump's new tax plan is not in effect yet so we are still held to a 35% tax rate. Our Net Working Capital is expected to increase by S20,000 due to pallet inventories which will naturally need to increase. A small business owner will pay us $90,000 for our older palletizer. What is the initial investment we would need in order to make this capital project a reality? machine being cd also using a sense still Problem #2 (8 points) A friend of mine is considering replacing a manual sheet metal press with a new automated one. His current one was purchased 4 years ago at a cost of $75,000 & is being depreciated using a 5 year-recovery period under MACRS. Their current press still has 5 years of useful life remaining. The new automated machine being considered costs 595,000+ another $10,000 to install it & will be depreciated also using a 5 year-recovery period under MACRS. He can sell the old one for $60,010 & is also still liable for a 35% tax rate because the tax plan is not law just yet. The expected revenue & expenses for both the new & the existing press for the next 5 years is as follows: (Expenses exclude depreciation & interest) YEAR EXISTING MANUAL PRESS NEW AUTOMATED PRESS REVENUE EXPENSES REVENUE EXPENSES S699,000 $685,000 $795,000 $745,000 $701,000 $685.000 $795,000 $745,000 $705,000 $685.000 5795.000 $745.000 $703,000 $685,000 $795,000 $745,000 S699,000 $685,000 $795,000 $745,000 1. Calculate the initial investment necessary to purchase the new press 2. Determine the incremental operating cash inflows realized by the replacement (consider depreciation in year 6)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts