Question: Problem 1 7 - 4 4 ( LO 1 7 - 2 ) ( Algo ) Cass Corporation reported pretax book income of $ 1

Problem LO Algo

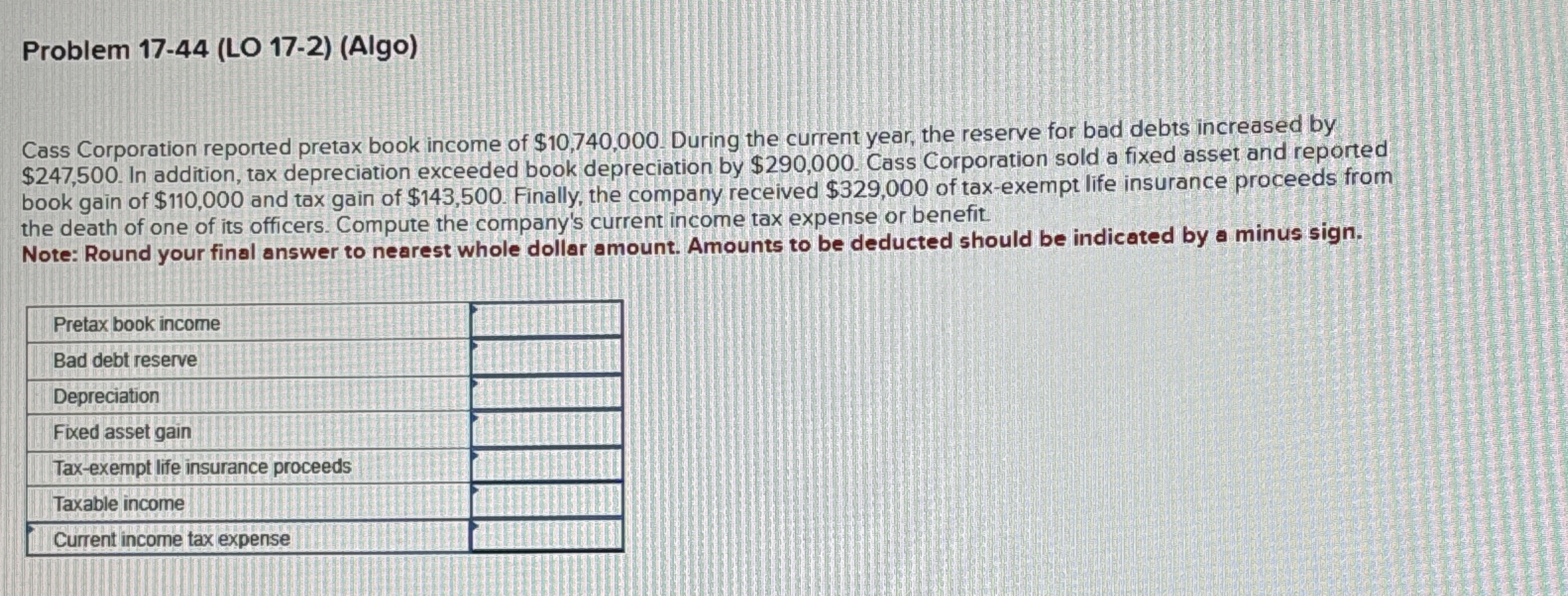

Cass Corporation reported pretax book income of $ During the current year, the reserve for bad debts increased by $ In addition, tax depreciation exceeded book depreciation by $ Cass Corporation sold a fixed asset and reported book gain of $ and tax gain of $ Finally, the company received $ of taxexempt life insurance proceeds from the death of one of its officers. Compute the company's current income tax expense or benefit.

Note: Round your final answer to nearest whole dollar amount. Amounts to be deducted should be indicated by a minus sign.

tablePretax book income,Bad debt reserve,DepreciationFixed asset gain,Taxexempt life insurance proceeds,Taxable income,Current income tax expense,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock