Question: Problem 1 - 7 B Analyzing transactions and preparing financial statements P 1 P 2 Nina Niko launched a new business, Niko's Maintenance Co .

Problem B Analyzing transactions and preparing financial statements P P

Nina Niko launched a new business, Niko's Maintenance Co that began operations on June The following transactions were completed by the company during that first month.

June Nina Niko invested $ cash in the company in exchange for its common stock.

The company rented a furnished office and paid $ cash for June's rent.

The company purchased $ of equipment on credit.

The company paid $ cash for this month's advertising of the opening of the business.

The company completed maintenance services for a customer and immediately collected $ cash.

The company completed $ of maintenance services for City Center on credit.

The company paid $ cash for an assistant's salary for the first half of the month.

The company received $ cash payment for services completed for City Center on June

The company completed $ of maintenance services for Paula's Beauty Shop on credit.

The company completed $ of maintenance services for BuildIt Coop on credit.

The company received $ cash payment from Paula's Beauty Shop for the work completed on June

The company made payment of $ cash for equipment purchased on June

The company paid $ cash for an assistant's salary for the second half of this month.

The company paid $ cash in dividends to the owner sole shareholder

The company paid $ cash for this month's telephone bill.

The company paid $ cash for this month's utilities.

YouTube

Spotify

Google Calender

Canvas

Lion Path

Quizlet

Detection of Latent...

Blood on Black Enh...

Processed foods ma

We are what we eat:...

Common

of

The company paid $ cash for this month's telephone bill.

The company paid $ cash for this month's utilities.

Page

Create the following table similar to Exhibit Enter the effects of each transaction on the accounts of the accounting equation by recording dollar increases and decreases in the appropriate columns. Determine the final total for each account and verify that the equation is in balance.

Check

Ending balances: Cash, $; Expenses, $

Prepare the income statement and the statement of retained earnings for the month of June, and the balance sheet as of June

Net income, $; Total assets, $

Prepare the statement of cash flows for the month of June.

P P

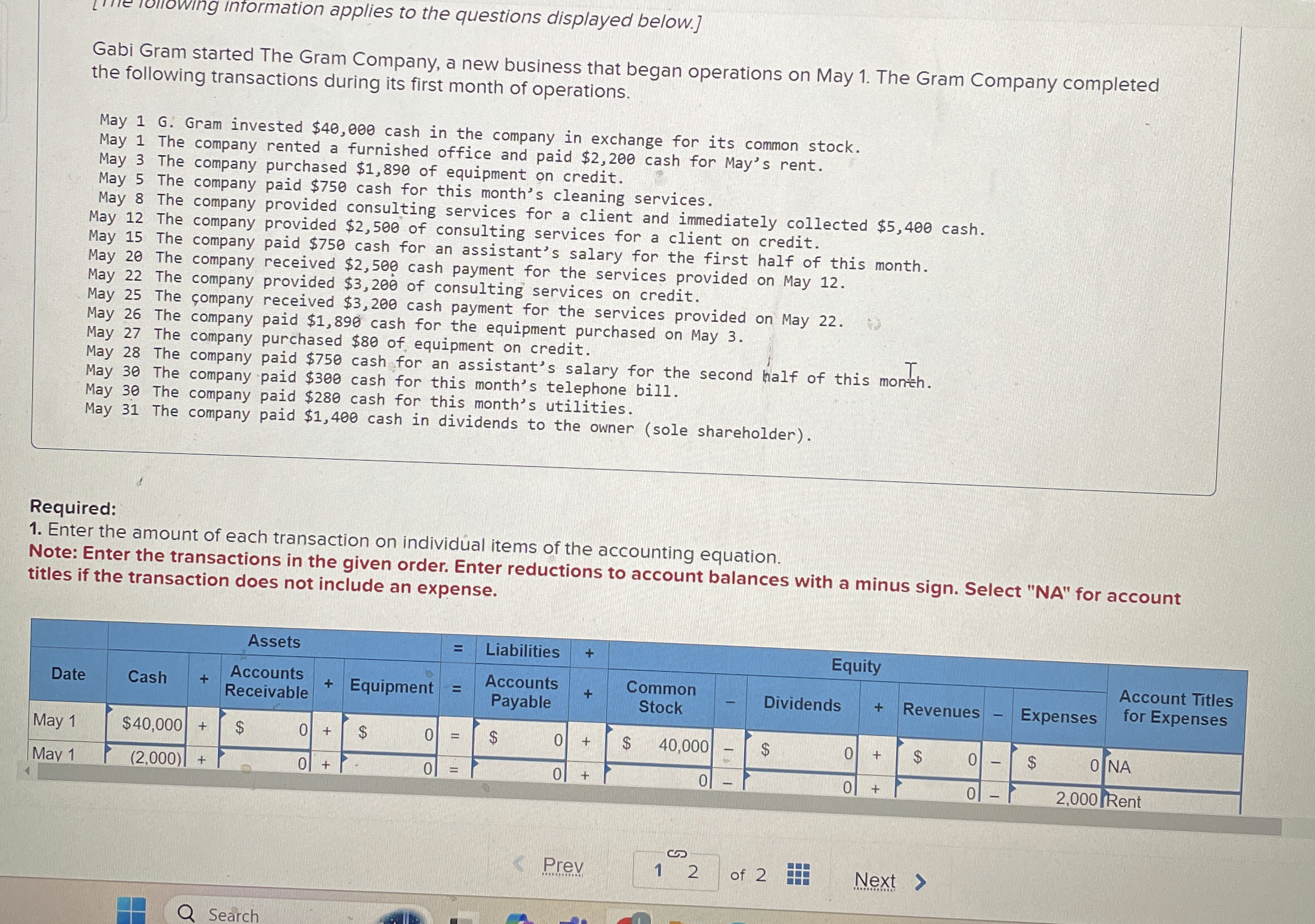

Gabi Gram started The Gram Company, a new business that began operations on May The Gram Company completed

the following transactions during its first month of operations.

May G Gram invested $ cash in the company in exchange for its common stock.

May The company rented a furnished office and paid $ cash for May's rent.

May The company purchased $ of equipment on credit.

May The company paid $ cash for this month's cleaning services.

May The company provided consulting services for a client and immediately collected $ cash.

May The company provided $ of consulting services for a client on credit.

May The company paid $ cash for an assistant's salary for the first half of this month.

May The company received $ cash payment for the services provided on May

May The company provided $ of consulting services on credit.

May The company received $ cash payment for the services provided on May

May The company paid $ cash for the equipment purchased on May

May The company purchased $ of equipment on credit.

May The company paid $ cash for an assistant's salary for the second half of this month.

May The company paid $ cash for this month's telephone bill.

May The company paid $ cash for this month's utilities.

May The company paid $ cash in di

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock