Question: Problem 1 7 : On January 1 , 2 0 2 1 , Entity A started the construction of a building contract can be estimated

Problem : On January Entity A started the construction of a building contract can be estimated reliably. The project was completed on December

which resulted to penalty amounting to The entity provided the following

data concerning the direct costs related to the said project for and :

What is the construction revenue for the year ended December

a P

c P

b P

d P

What is the realized gross profit for the year ended December

a

c P

b P

d

What is the balance of construction in progress on December

a P

c

b P

d P

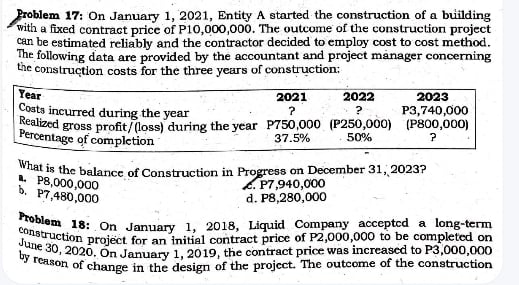

with a fixed contract price of P The outcome of the construction project

can be estimated reliably and the contractor decided to employ cost to cost method.

The following data are provided by the accountant and project manager concerning

the construction costs for the three years of construction:

What is the balance of Construction in Progress on December

a P

l

b P

d

Problem : On January Liquid Company accepted a longterm

construction project for an initial contract price of P to be completed on

June On January the contract price was increased to P

by reason of change in the design of the project. The outcome of the construction

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock