Question: Problem 1 7 : Option ( 1 5 % ) The stock price of Johnson & Johnson ( JNJ ) is trading at $ 1

Problem : Option

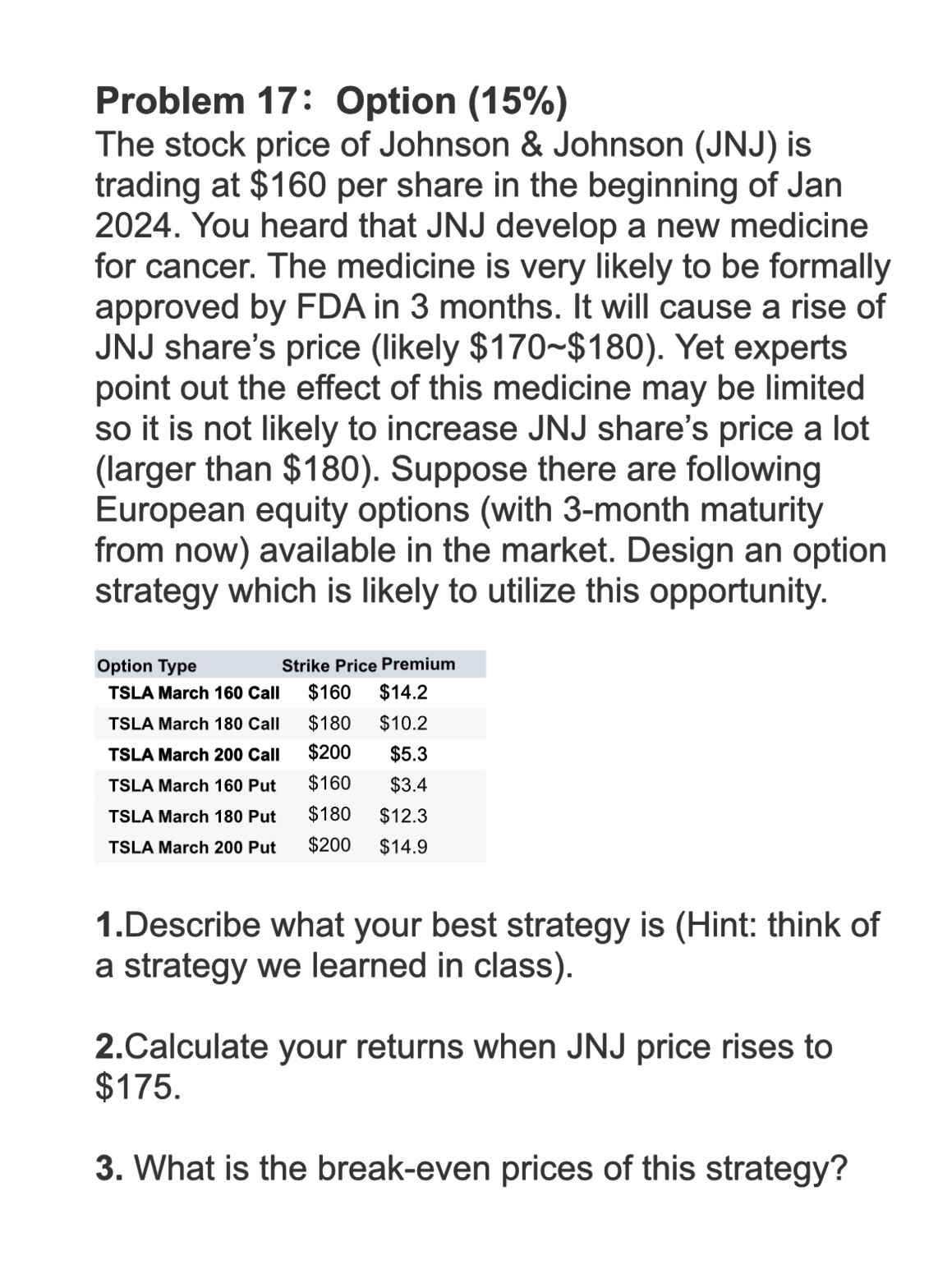

The stock price of Johnson & Johnson JNJ is trading at $ per share in the beginning of Jan You heard that JNJ develop a new medicine for cancer. The medicine is very likely to be formally approved by FDA in months. It will cause a rise of JNJ share's price likely $ $ Yet experts point out the effect of this medicine may be limited so it is not likely to increase JNJ share's price a lot larger than $ Suppose there are following European equity options with month maturity from now available in the market. Design an option strategy which is likely to utilize this opportunity.

tableOption Type,Strike Price PremiumTSLA March Call,$$TSLA March Call,$$TSLA March Call,$$TSLA March Put,$$TSLA March Put,$$TSLA March Put,$$

Describe what your best strategy is Hint: think of a strategy we learned in class

Calculate your returns when JNJ price rises to $

What is the breakeven prices of this strategy?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock