Question: Problem 1 (7 points) Consider the Diamond-Dybvig model. There are three dates (T=0, 1, 2) and a unit mass of ex-ante identical consumers. Each of

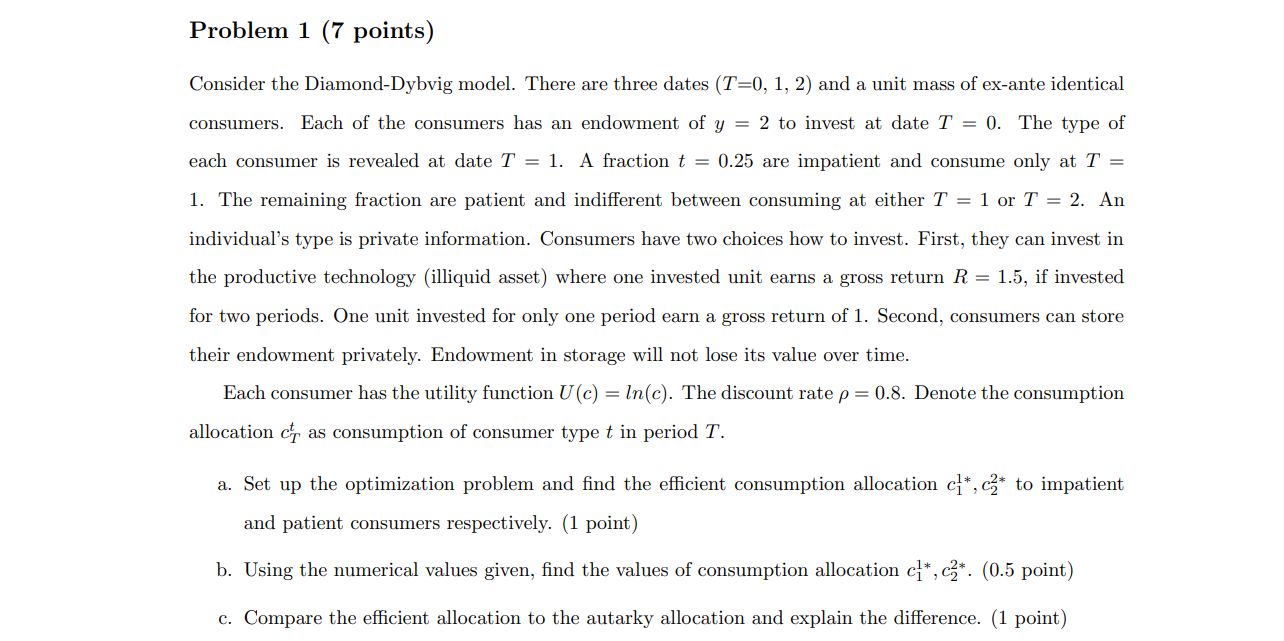

Problem 1 (7 points) Consider the Diamond-Dybvig model. There are three dates (T=0, 1, 2) and a unit mass of ex-ante identical consumers. Each of the consumers has an endowment of y = 2 to invest at date T = 0. The type of each consumer is revealed at date T = 1. A fraction t = 0.25 are impatient and consume only at T = 1. The remaining fraction are patient and indifferent between consuming at either T = 1 or T = 2. An individual's type is private information. Consumers have two choices how to invest. First, they can invest in the productive technology (illiquid asset) where one invested unit earns a gross return R = 1.5, if invested for two periods. One unit invested for only one period earn a gross return of 1. Second, consumers can store their endowment privately. Endowment in storage will not lose its value over time. Each consumer has the utility function UC) = ln(c). The discount rate p=0.8. Denote the consumption allocation c, as consumption of consumer type t in period T. a. Set up the optimization problem and find the efficient consumption allocation c1*, ca* to impatient and patient consumers respectively. (1 point) b. Using the numerical values given, find the values of consumption allocation c]* c*. (0.5 point) c. Compare the efficient allocation to the autarky allocation and explain the difference. (1 point) Problem 1 (7 points) Consider the Diamond-Dybvig model. There are three dates (T=0, 1, 2) and a unit mass of ex-ante identical consumers. Each of the consumers has an endowment of y = 2 to invest at date T = 0. The type of each consumer is revealed at date T = 1. A fraction t = 0.25 are impatient and consume only at T = 1. The remaining fraction are patient and indifferent between consuming at either T = 1 or T = 2. An individual's type is private information. Consumers have two choices how to invest. First, they can invest in the productive technology (illiquid asset) where one invested unit earns a gross return R = 1.5, if invested for two periods. One unit invested for only one period earn a gross return of 1. Second, consumers can store their endowment privately. Endowment in storage will not lose its value over time. Each consumer has the utility function UC) = ln(c). The discount rate p=0.8. Denote the consumption allocation c, as consumption of consumer type t in period T. a. Set up the optimization problem and find the efficient consumption allocation c1*, ca* to impatient and patient consumers respectively. (1 point) b. Using the numerical values given, find the values of consumption allocation c]* c*. (0.5 point) c. Compare the efficient allocation to the autarky allocation and explain the difference. (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts