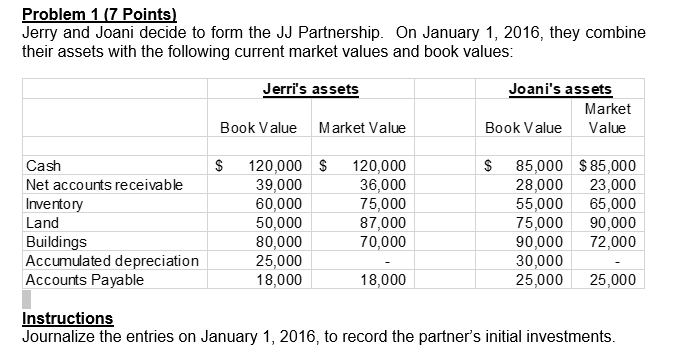

Question: Problem 1 (7 Points) Jerry and Joani decide to form the JJ Partnership. On January 1, 2016, they combine their assets with the following current

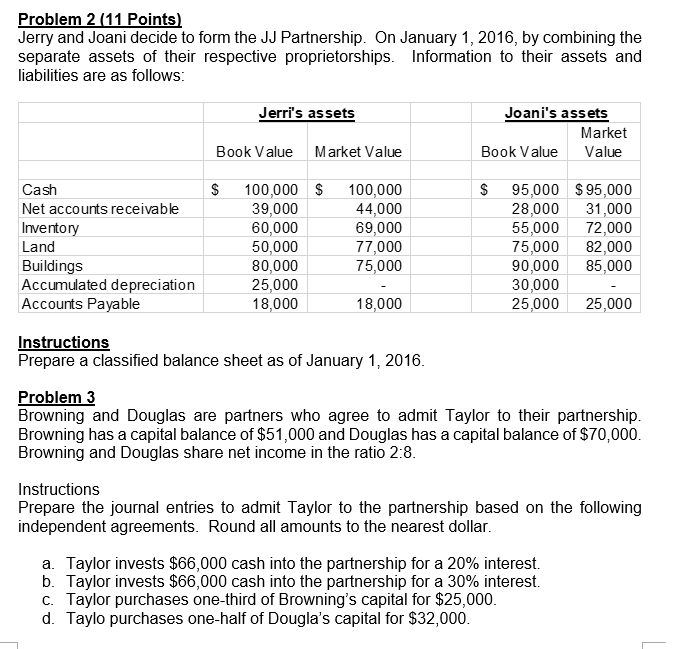

Problem 1 (7 Points) Jerry and Joani decide to form the JJ Partnership. On January 1, 2016, they combine their assets with the following current market values and book values: Jerri's assets Joani's assets Market Book Value Market Value Book Value Value Cash S 120,000 $ 120,000 S 85,000 $ 85,000 Net accounts receivable 39,000 36,000 28.000 23,000 Inventory 60,000 75,000 55.000 65,000 Land 50.000 87,000 75.000 90,000 Buildings 80,000 70,000 90,000 72,000 Accumulated depreciation 25,000 30,000 Accounts Payable 18,000 18,000 25,000 25,000 Instructions Journalize the entries on January 1, 2016, to record the partner's initial investments.Problem 2 (11 Points) Jerry and Joani decide to form the JJ Partnership. On January 1, 2016, by combining the separate assets of their respective proprietorships. Information to their assets and liabilities are as follows: Jerri's assets Joani's assets Market Book Value Market Value Book Value Value Cash $ 100,000 100,000 95,000 $ 95,000 Net accounts receivable 39,000 44,000 28,000 31,000 Inventory 60,000 69,000 55,000 72,000 Land 50,000 77,000 75,000 82,000 Buildings 80,000 75,000 90,000 85,000 Accumulated depreciation 25,000 30,000 Accounts Payable 18,000 18,000 25,000 25,000 Instructions Prepare a classified balance sheet as of January 1, 2016. Problem 3 Browning and Douglas are partners who agree to admit Taylor to their partnership. Browning has a capital balance of $51,000 and Douglas has a capital balance of $70,000. Browning and Douglas share net income in the ratio 2:8. Instructions Prepare the journal entries to admit Taylor to the partnership based on the following independent agreements. Round all amounts to the nearest dollar. a. Taylor invests $66,000 cash into the partnership for a 20% interest. b. Taylor invests $66,000 cash into the partnership for a 30% interest. C. Taylor purchases one-third of Browning's capital for $25,000 d. Taylo purchases one-half of Dougla's capital for $32,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts