Question: Problem 1 8 - 2 2 APV and issue costs The Bunsen Chemical Company is currently at its target debt ratio of ( 4

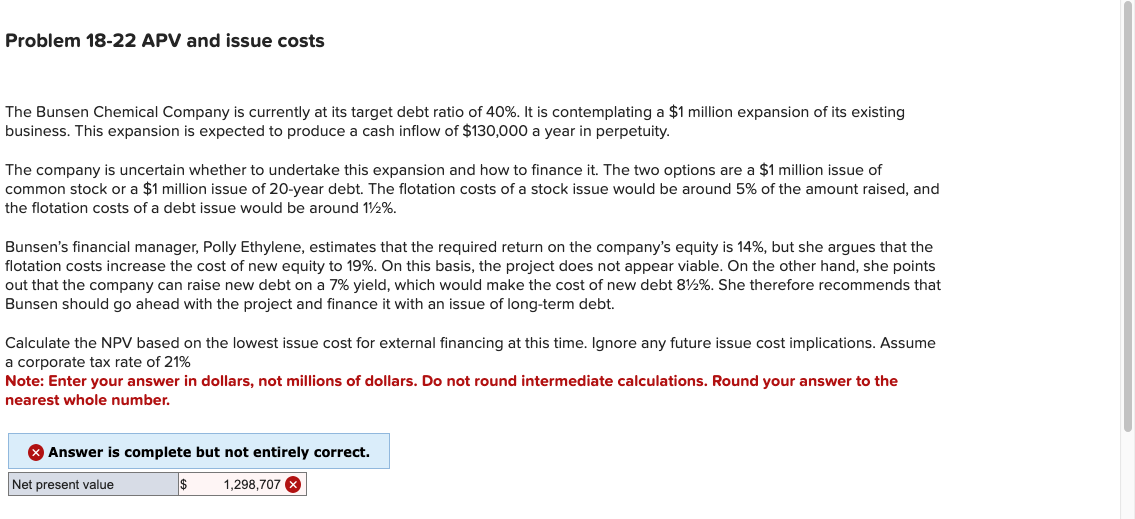

Problem APV and issue costs The Bunsen Chemical Company is currently at its target debt ratio of It is contemplating a $ million expansion of its existing business. This expansion is expected to produce a cash inflow of $ a year in perpetuity. The company is uncertain whether to undertake this expansion and how to finance it The two options are a $ million issue of common stock or a $ million issue of year debt. The flotation costs of a stock issue would be around of the amount raised, and the flotation costs of a debt issue would be around Bunsen's financial manager, Polly Ethylene, estimates that the required return on the company's equity is but she argues that the flotation costs increase the cost of new equity to On this basis, the project does not appear viable. On the other hand, she points out that the company can raise new debt on a yield, which would make the cost of new debt She therefore recommends that Bunsen should go ahead with the project and finance it with an issue of longterm debt. Calculate the NPV based on the lowest issue cost for external financing at this time. Ignore any future issue cost implications. Assume a corporate tax rate of Note: Enter your answer in dollars, not millions of dollars. Do not round intermediate calculations. Round your answer to the nearest whole number. Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock