Question: Problem 1 8 - 5 0 ( Algo ) ( LO 1 8 - 2 , 1 8 - 8 ) points A local private

Problem AlgoLO

points

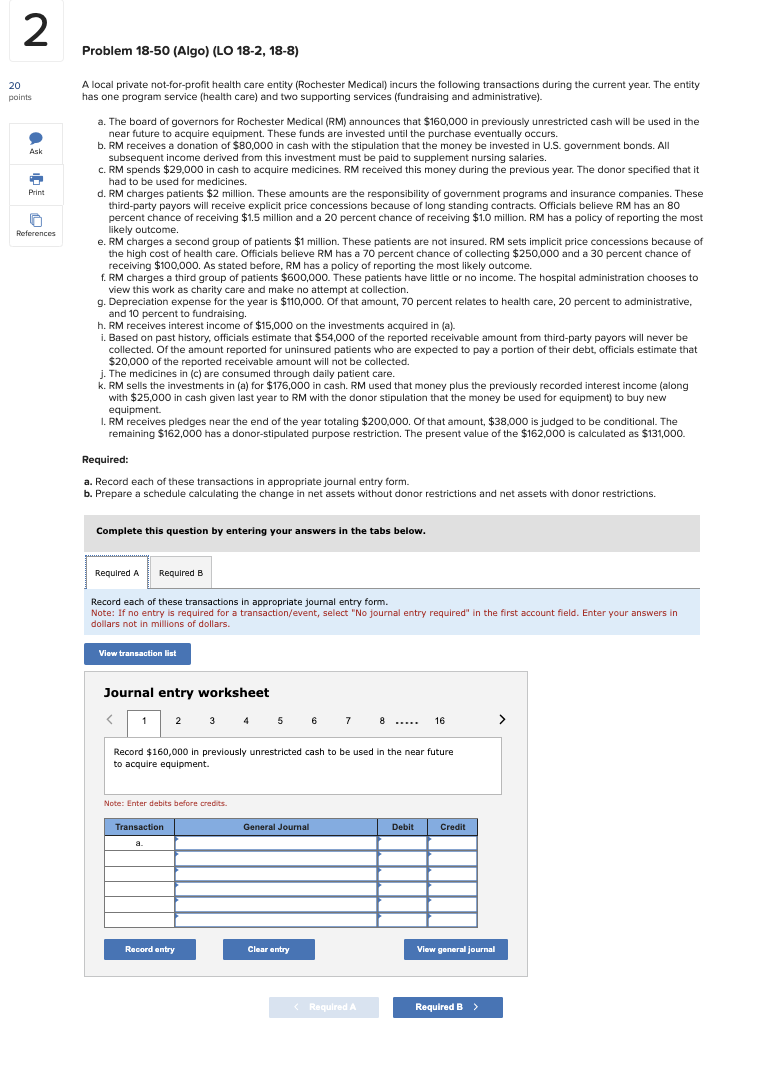

A local private notforprofit health care entity Rochester Medical incurs the following transactions during the current year. The entity has one program service health care and two supporting services fundraising and administrative

a The board of governors for Rochester Medical RM announces that $ in previously unrestricted cash will be used in the near future to acquire equipment. These funds are invested until the purchase eventually occurs.

b RM receives a donation of $ in cash with the stipulation that the money be invested in US government bonds. All subsequent income derived from this investment must be paid to supplement nursing salaries.

c RM spends $ in cash to acquire medicines. RM received this money during the previous year. The donor specified that it had to be used for medicines.

d RM charges patients $ million. These amounts are the responsibility of government programs and insurance companies. These thirdparty payors will receive explicit price concessions because of long standing contracts. Officials believe RM has an percent chance of receiving $ million and a percent chance of receiving $ million. RM has a policy of reporting the most likely outcome.

e RM charges a second group of patients $ million. These patients are not insured. RM sets implicit price concessions because of the high cost of health care. Officials believe RM has a percent chance of collecting $ and a percent chance of receiving $ As stated before, RM has a policy of reporting the most likely outcome.

f RM charges a third group of patients $ These patients have little or no income. The hospital administration chooses to view this work as charity care and make no attempt at collection.

g Depreciation expense for the year is $ Of that amount, percent relates to health care, percent to administrative, and percent to fundraising.

h RM receives interest income of $ on the investments acquired in a

i Based on past history, officials estimate that $ of the reported receivable amount from thirdparty payors will never be collected. Of the amount reported for uninsured patients who are expected to pay a portion of their debt, officials estimate that $ of the reported receivable amount will not be collected.

j The medicines in c are consumed through daily patient care.

k RM sells the investments in a for $ in cash. RM used that money plus the previously recorded interest income along with $ in cash given last year to RM with the donor stipulation that the money be used for equipment to buy new equipment.

RM receives pledges near the end of the year totaling $ Of that amount, $ is judged to be conditional. The remaining $ has a donorstipulated purpose restriction. The present value of the $ is calculated as $

Required:

a Record each of these transactions in appropriate journal entry form.

b Prepare a schedule calculating the change in net assets without donor restrictions and net assets with donor restrictions.

Complete this question by entering your answers in the tabs below.

Required A

Record each of these transactions in appropriate journal entry form.

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field. Enter your answers in dollars not in millions of dollars.

Journal entry worksheet

Record $ in previously unrestricted cash to be used in the near future to acquire equipment.

Note: Enter debits before credits. Required A

Required B

Prepare a schedule calculating the change in net assets without donor restrictions and net assets with donor restrictions.

Note: Deductions should be indicated by a minus sign. Enter your answers in dollars not in millions of dollars.

begintabularccc

hline & Assets Without Donor Restrictions & Assets With Donor Restrictions

hline Contribution revenue & &

hline Patient service revenues & &

hline Interest income & &

hline Gain on sale of investments & &

hline Reclassified from net assets with donor restrictions to net assets without donor restrictions & &

hline Contributions, revenues, and reclassifications & &

hline Expenses & &

hline Healthcare & &

hline Depreciation & &

hline Bad debts & &

hline Pharmaceutical & &

hline Administrative & &

hline Depreciation & &

hline Fundraising & &

hline Depreciation & &

hline Total expenses & &

hline Increase in net assets & $ & $

hline

endtabular

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock