Question: Problem 1 (9 marks) Consider an annuity consisting of three cash flows of $28,000 each. If the interest rate is 6%, what is the present

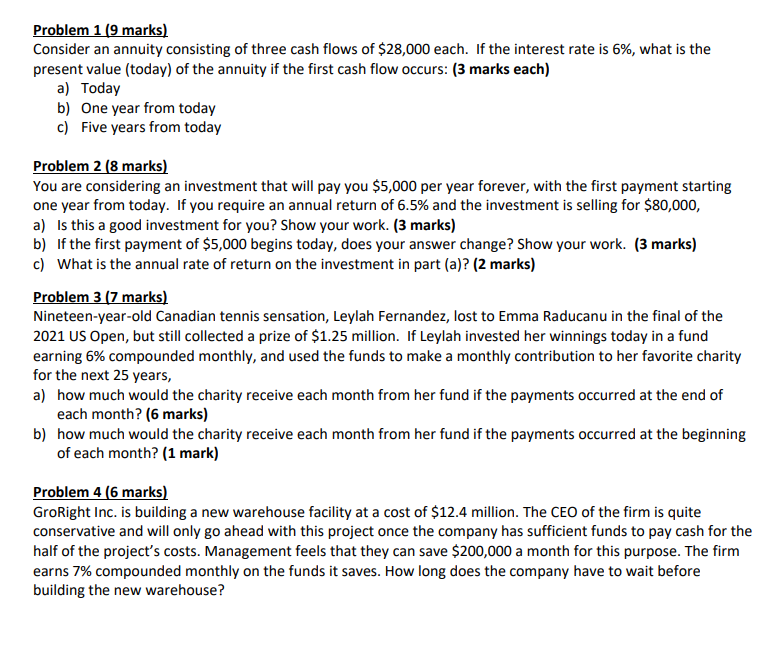

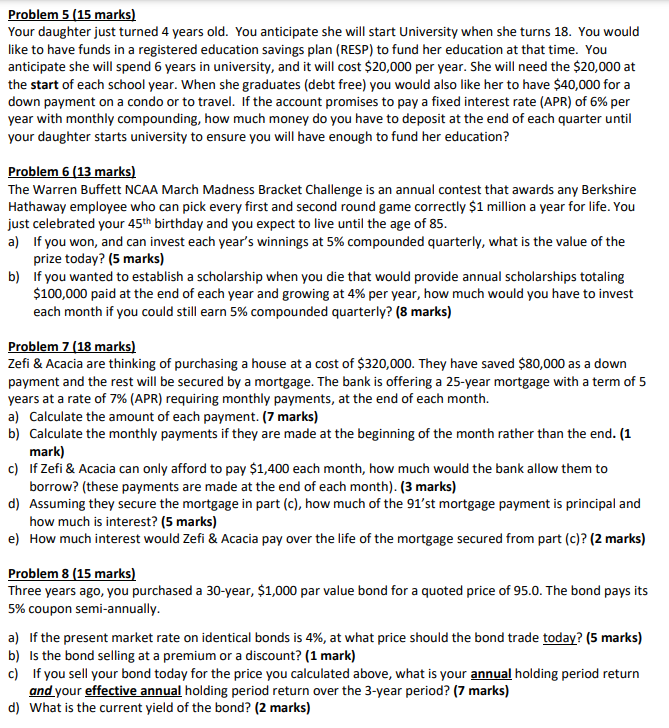

Problem 1 (9 marks) Consider an annuity consisting of three cash flows of $28,000 each. If the interest rate is 6%, what is the present value (today) of the annuity if the first cash flow occurs: (3 marks each) a) Today b) One year from today c) Five years from today Problem 2 (8 marks) You are considering an investment that will pay you $5,000 per year forever, with the first payment starting one year from today. If you require an annual return of 6.5% and the investment is selling for $80,000, a) Is this a good investment for you? Show your work. (3 marks) b) If the first payment of $5,000 begins today, does your answer change? Show your work. (3 marks) c) What is the annual rate of return on the investment in part (a)? (2 marks) Problem 3 (7 marks) Nineteen-year-old Canadian tennis sensation, Leylah Fernandez, lost to Emma Raducanu in the final of the 2021 US Open, but still collected a prize of $1.25 million. If Leylah invested her winnings today in a fund earning 6% compounded monthly, and used the funds to make a monthly contribution to her favorite charity for the next 25 years, a) how much would the charity receive each month from her fund if the payments occurred at the end of each month? (6 marks) b) how much would the charity receive each month from her fund if the payments occurred at the beginning of each month? (1 mark) Problem 4 (6 marks) GroRight Inc. is building a new warehouse facility at a cost of $12.4 million. The CEO of the firm is quite conservative and will only go ahead with this project once the company has sufficient funds to pay cash for the half of the project's costs. Management feels that they can save $200,000 a month for this purpose. The firm earns 7% compounded monthly on the funds it saves. How long does the company have to wait before building the new warehouse? Problem 5 (15 marks) Your daughter just turned 4 years old. You anticipate she will start University when she turns 18. You would like to have funds in a registered education savings plan (RESP) to fund her education at that time. You anticipate she will spend 6 years in university, and it will cost $20,000 per year. She will need the $20,000 at the start of each school year. When she graduates (debt free) you would also like her to have $40,000 for a down payment on a condo or to travel. If the account promises to pay a fixed interest rate (APR) of 6% per year with monthly compounding, how much money do you have to deposit at the end of each quarter until your daughter starts university to ensure you will have enough to fund her education? Problem 6 (13 marks) The Warren Buffett NCAA March Madness Bracket Challenge is an annual contest that awards any Berkshire Hathaway employee who can pick every first and second round game correctly $1 million a year for life. You just celebrated your 45th birthday and you expect to live until the age of 85. a) If you won, and can invest each year's winnings at 5% compounded quarterly, what is the value of the prize today? (5 marks) b) If you wanted to establish a scholarship when you die that would provide annual scholarships totaling $100,000 paid at the end of each year and growing at 4% per year, how much would you have to invest each month if you could still earn 5% compounded quarterly? (8 marks) Problem 7 (18 marks) Zefi & Acacia are thinking of purchasing a house at a cost of $320,000. They have saved $80,000 as a down payment and the rest will be secured by a mortgage. The bank is offering a 25-year mortgage with a term of 5 years at a rate of 7% (APR) requiring monthly payments at the end of each month. a) Calculate the amount of each payment. (7 marks) b) Calculate the monthly payments if they are made at the beginning of the month rather than the end. (1 mark) c) If Zefi & Acacia can only afford to pay $1,400 each month, how much would the bank allow them to borrow? (these payments are made at the end of each month). (3 marks) d) Assuming they secure the mortgage in part (c), how much of the 91'st mortgage payment is principal and how much is interest? (5 marks) e) How much interest would Zefi & Acacia pay over the life of the mortgage secured from part (c)? (2 marks) Problem 8 (15 marks) Three years ago, you purchased a 30-year, $1,000 par value bond for a quoted price of 95.0. The bond pays its 5% coupon semi-annually. a) If the present market rate on identical bonds is 4%, at what price should the bond trade today? (5 marks) b) Is the bond selling at a premium or a discount? (1 mark) c) If you sell your bond today for the price you calculated above, what is your annual holding period return and your effective annual holding period return over the 3-year period? (7 marks) d) What is the current yield of the bond? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts