Question: Problem 1. (9 points) A new process can be developed for $125,000 (Year (). Annual operating costs and sales are estimated to be $50,000 and

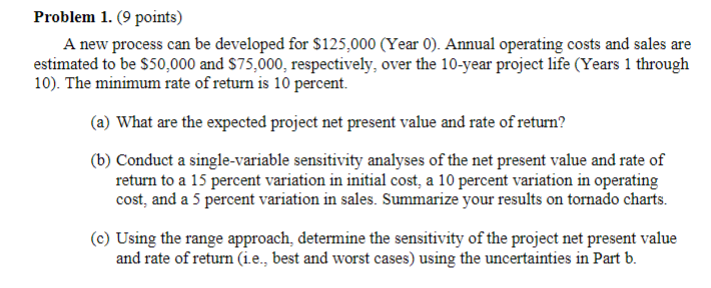

Problem 1. (9 points) A new process can be developed for $125,000 (Year (). Annual operating costs and sales are estimated to be $50,000 and $75,000, respectively, over the 10-year project life (Years 1 through 10). The minimum rate of return is 10 percent. (a) What are the expected project net present value and rate of return? (b) Conduct a single-variable sensitivity analyses of the net present value and rate of return to a 15 percent variation in initial cost, a 10 percent variation in operating cost, and a 5 percent variation in sales. Summarize your results on tornado charts. (c) Using the range approach, determine the sensitivity of the project net present value and rate of return (i.e., best and worst cases) using the uncertainties in Part b. Problem 1. (9 points) A new process can be developed for $125,000 (Year (). Annual operating costs and sales are estimated to be $50,000 and $75,000, respectively, over the 10-year project life (Years 1 through 10). The minimum rate of return is 10 percent. (a) What are the expected project net present value and rate of return? (b) Conduct a single-variable sensitivity analyses of the net present value and rate of return to a 15 percent variation in initial cost, a 10 percent variation in operating cost, and a 5 percent variation in sales. Summarize your results on tornado charts. (c) Using the range approach, determine the sensitivity of the project net present value and rate of return (i.e., best and worst cases) using the uncertainties in Part b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts