Question: Problem 1 A fixed - income trader observes a three - year, 6 . 8 0 % annual - pay corporate bond trading at 1

Problem

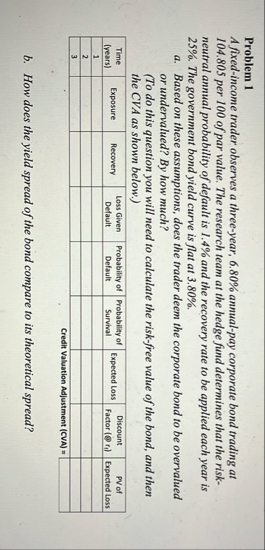

A fixedincome trader observes a threeyear, annualpay corporate bond trading at per of par value. The research team at the hedge fund determines that the riskneutral annual probability of default is and the recovery rate to be applied each year is The government bond yield curve is flat at

a Based on these assumptions, does the trader deem the corporate bond to be overvalued or undervalued? By how much?

To do this question you will need to calculate the riskfree value of the bond, and then the CVA as shown below.

tabletableTimeyearsExposure,Recovery,tableLoss GivenDefaulttableProbability ofDefaulttableProbability ofSurvivalExpected Loss,tableDiscountFactor @ tablePV ofExpected Loss

b How does the yield spread of the bond compare to its theoretical spread?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock