Question: Problem 1 : A mining company is evaluating a section of a gold deposit to decide whether it is economically viable to develop a new

Problem :

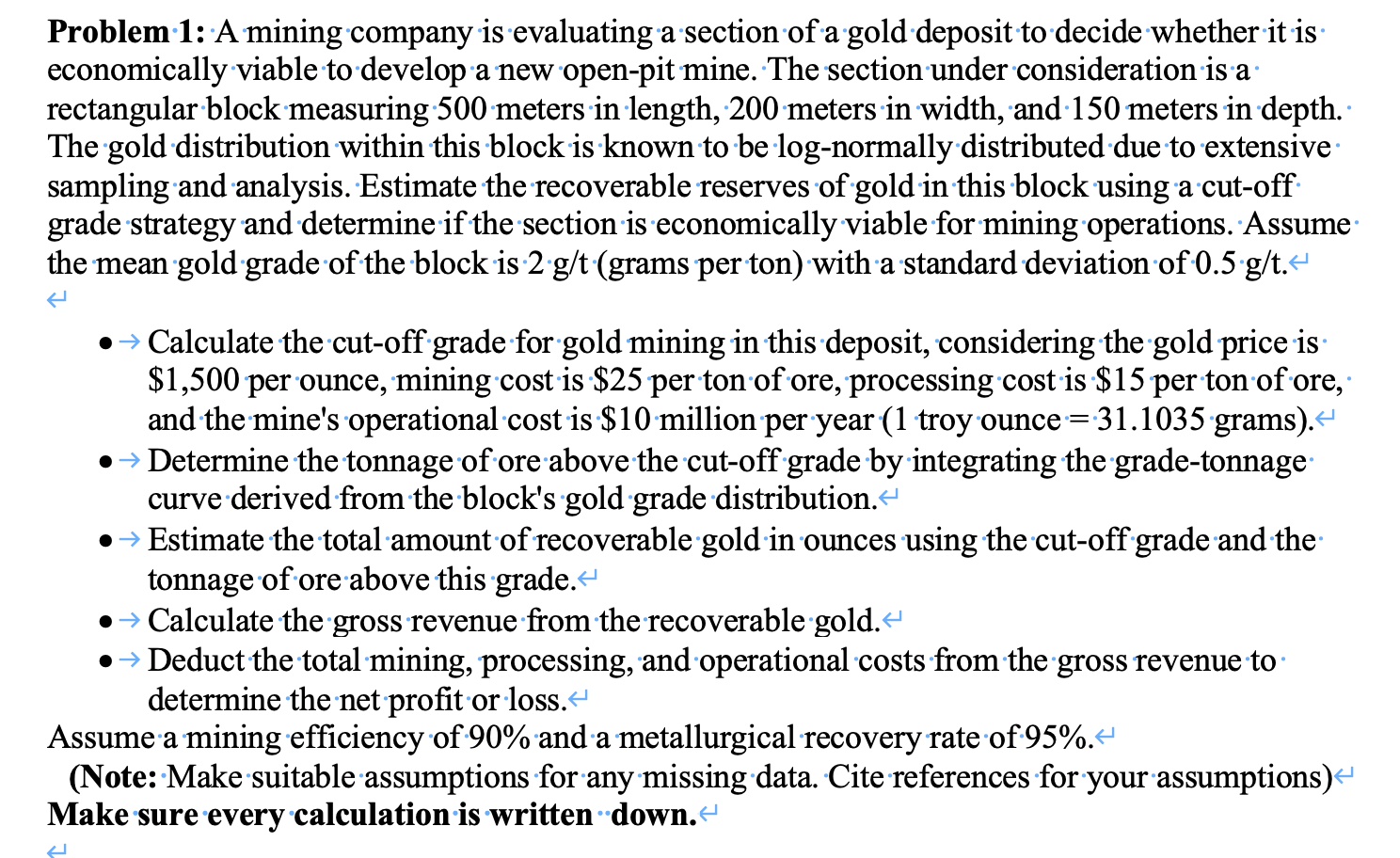

A mining company is evaluating a section of a gold deposit to decide whether it is economically viable to develop a new openpit mine. The section under consideration is a rectangular block measuring meters in length, meters in width, and meters in depth. The gold distribution within this block is known to be lognormally distributed due to extensive sampling and analysis. Estimate the recoverable reserves of gold in this block using a cutoff grade strategy and determine if the section is economically viable for mining operations. Assume the mean gold grade of the block is gt grams per ton with a standard deviation of gt

Calculate the cutoff grade for gold mining in this deposit, considering the gold price is $ per ounce, mining cost is $ per ton of ore, processing cost is $ per ton of ore, and the mine's operational cost is $ million per year troy ounce grams

Determine the tonnage of ore above the cutoff grade by integrating the gradetonnage curve derived from the block's gold grade distribution.

Estimate the total amount of recoverable gold in ounces using the cutoff grade and the tonnage of ore above this grade.

Calculate the gross revenue from the recoverable gold.

Deduct the total mining, processing, and operational costs from the gross revenue to determine the net profit or loss.

Assume a mining efficiency of and a metallurgical recovery rate of

Note: Make suitable assumptions for any missing data. Cite references for your assumptions

Make sure every calculation is written down.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock