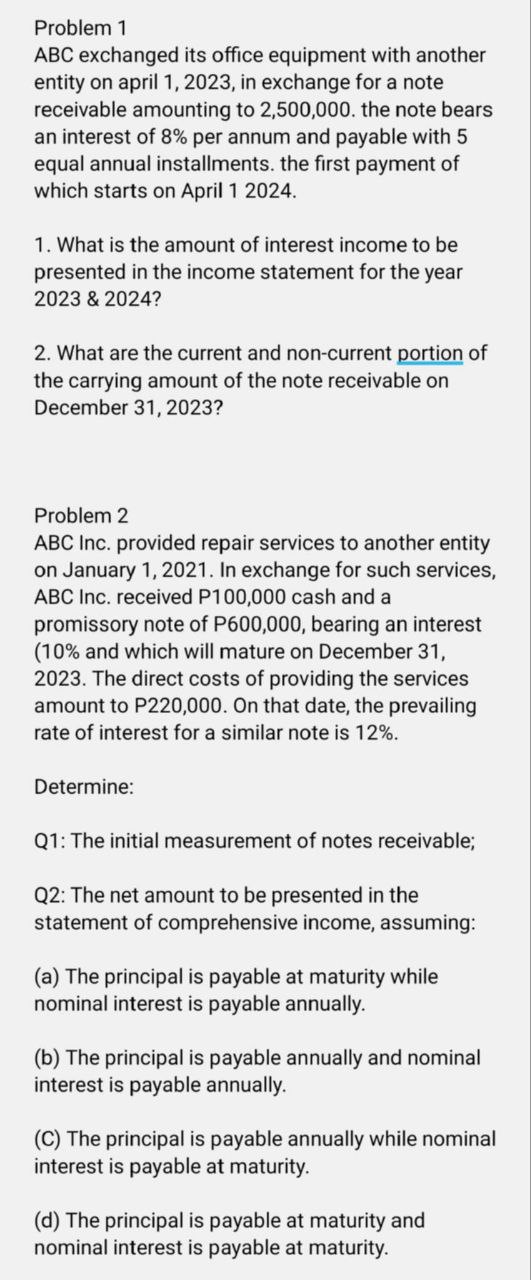

Question: Problem 1 ABC exchanged its office equipment with another entity on april 1 , 2 0 2 3 , in exchange for a note receivable

Problem

ABC exchanged its office equipment with another

entity on april in exchange for a note

receivable amounting to the note bears

an interest of per annum and payable with

equal annual installments. the first payment of

which starts on April

What is the amount of interest income to be

presented in the income statement for the year

&

What are the current and noncurrent portion of

the carrying amount of the note receivable on

December

Problem

ABC Inc. provided repair services to another entity

on January In exchange for such services,

ABC Inc. received cash and a

promissory note of bearing an interest

and which will mature on December

The direct costs of providing the services

amount to On that date, the prevailing

rate of interest for a similar note is

Determine:

Q: The initial measurement of notes receivable;

Q: The net amount to be presented in the

statement of comprehensive income, assuming:

a The principal is payable at maturity while

nominal interest is payable annually.

b The principal is payable annually and nominal

interest is payable annually.

C The principal is payable annually while nominal

interest is payable at maturity.

d The principal is payable at maturity and

nominal interest is payable at maturity.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock