Question: Problem 1 Alpha Company is constructing a building. Alpha began its construction on January 1 and completed construction on December 3 1 . Alpha had

Problem

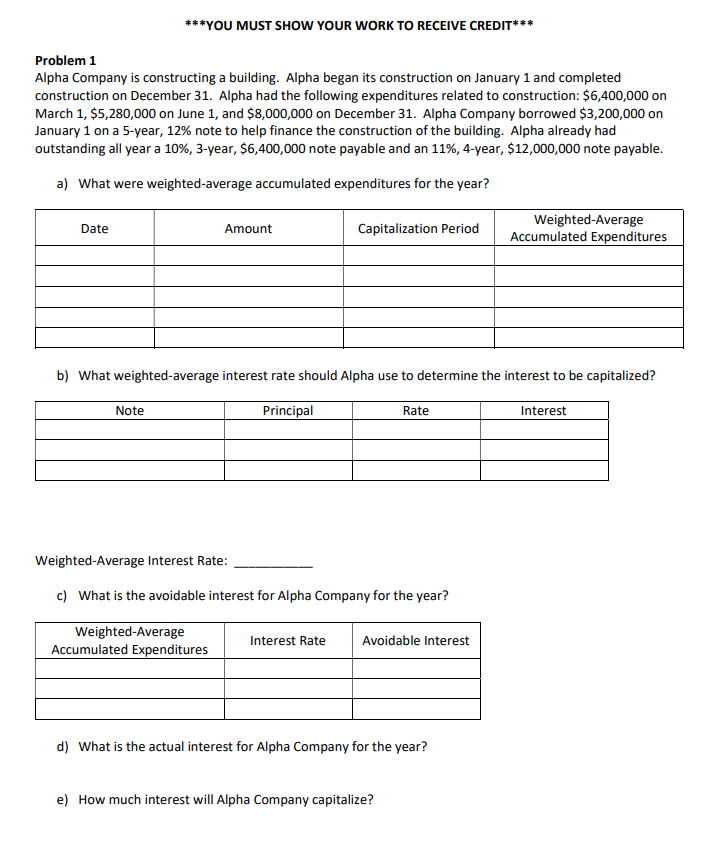

Alpha Company is constructing a building. Alpha began its construction on January and completed construction on December Alpha had the following expenditures related to construction: $ on March $ on June and $ on December Alpha Company borrowed $ on January on a year, note to help finance the construction of the building. Alpha already had outstanding all year a year, $ note payable and an year, $ note payable.

a What were weightedaverage accumulated expenditures for the year?

b What weightedaverage interest rate should Alpha use to determine the interest to be capitalized?

WeightedAverage Interest Rate:

c What is the avoidable interest for Alpha Company for the year?

d What is the actual interest for Alpha Company for the year?

e How much interest will Alpha Company capitalize? Problem

Beta Company exchanged machinery with Gamma Corporation for machinery Gamma owns. The following is provided for each company's assets in the exchange:

Gamma also gave Beta $ in the exchange. Assume depreciation has already been updated.

Prepare the entries on both companies' books assuming the exchange had commercial substance.

Prepare the entries on both companies' books assuming the exchange lacked commercial substance. Problem

The Delta Corporation is disposing of a piece of equipment on May The equipment had an original cost of $ when purchased on January Accumulated depreciation as of was $ assuming straightline depreciation over a useful life of years with no salvage value. Delta received $ on the sale of the equipment. Record the necessary entries for the sale.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock