Question: problem 1 and 2 Rory Company has an old machine with a book value of $79,000 and a remaining five-year useful life. Rory is considering

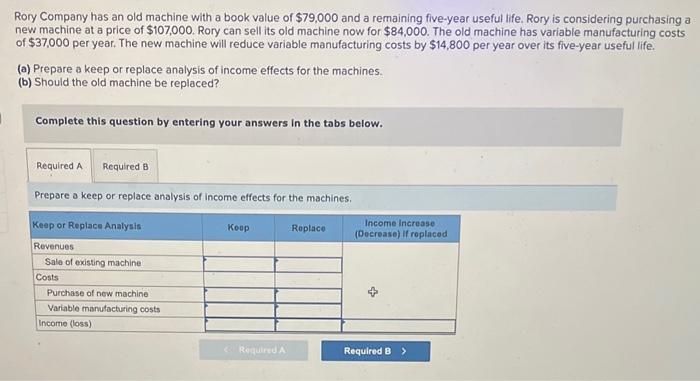

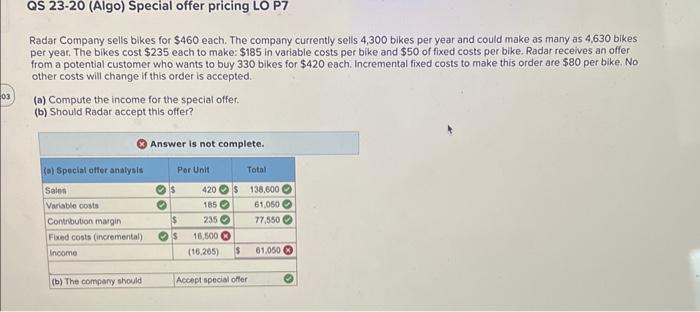

Rory Company has an old machine with a book value of $79,000 and a remaining five-year useful life. Rory is considering purchasing a new machine at a price of $107,000. Rory can sell its old machine now for $84,000. The old machine has variable manufacturing costs of $37,000 per year. The new machine will reduce variable manufacturing costs by $14,800 per year over its five-year useful life. (a) Prepare a keep or replace analysis of income effects for the machines. (b) Should the old machine be replaced? Complete this question by entering your answers in the tabs below. Prepare a keep or replace analysis of income effects for the machines. QS 23-20 (Algo) Special offer pricing LO P7 Radar Company sells bikes for $460 each. The company currently sells 4,300 bikes per year and could make as many as 4,630 bikes per year. The bikes cost $235 each to make: $185 in variable costs per bike and $50 of fixed costs per bike. Radar receives an offer from a potential customer who wants to buy 330 bikes for $420 each. Incremental fixed costs to make this order are $80 per bike. No other costs will change if this order is accepted. (a) Compute the income for the special offer. (b) Should Radar accept this offer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts