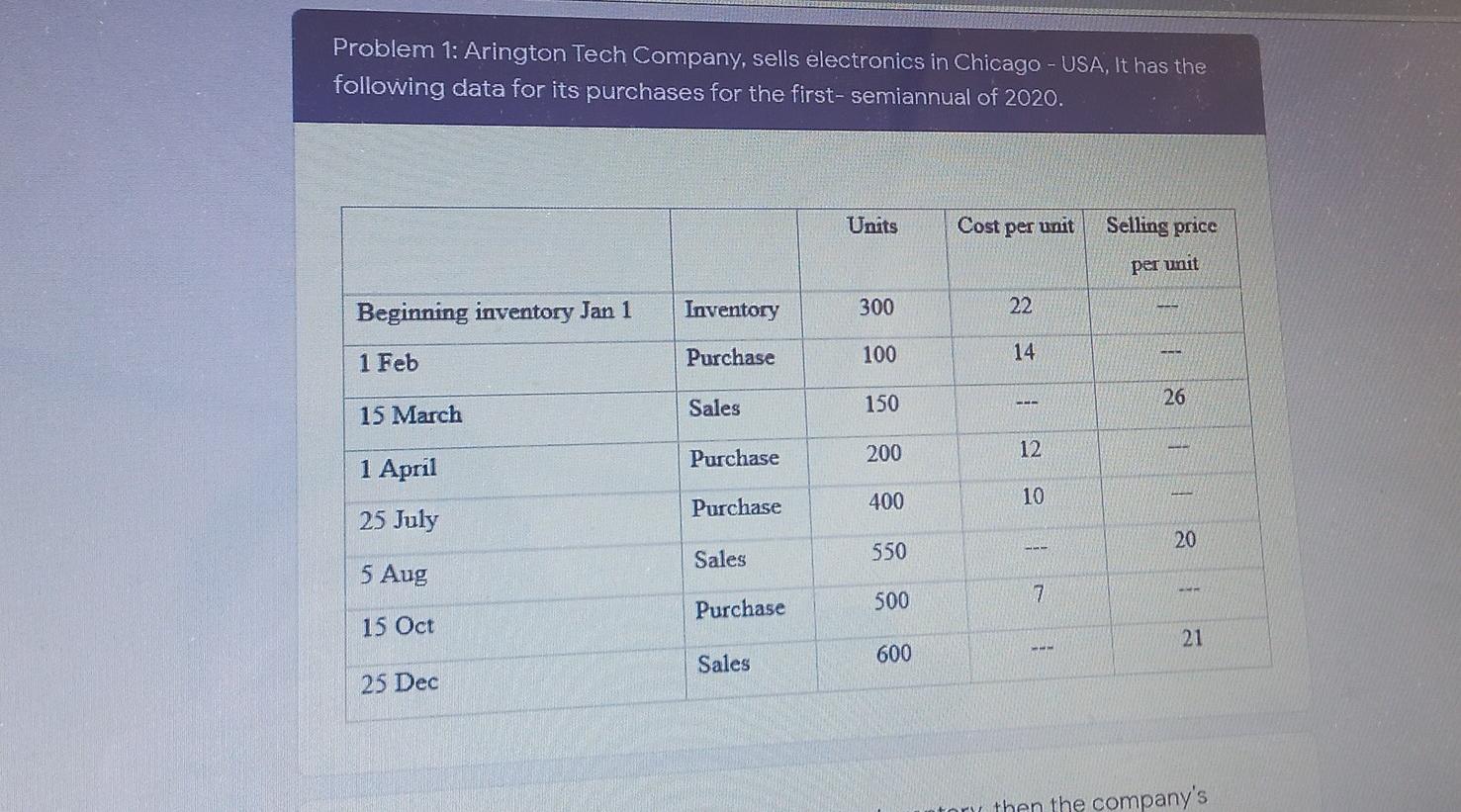

Question: Problem 1: Arington Tech Company, sells electronics in Chicago - USA, It has the following data for its purchases for the first- semiannual of 2020.

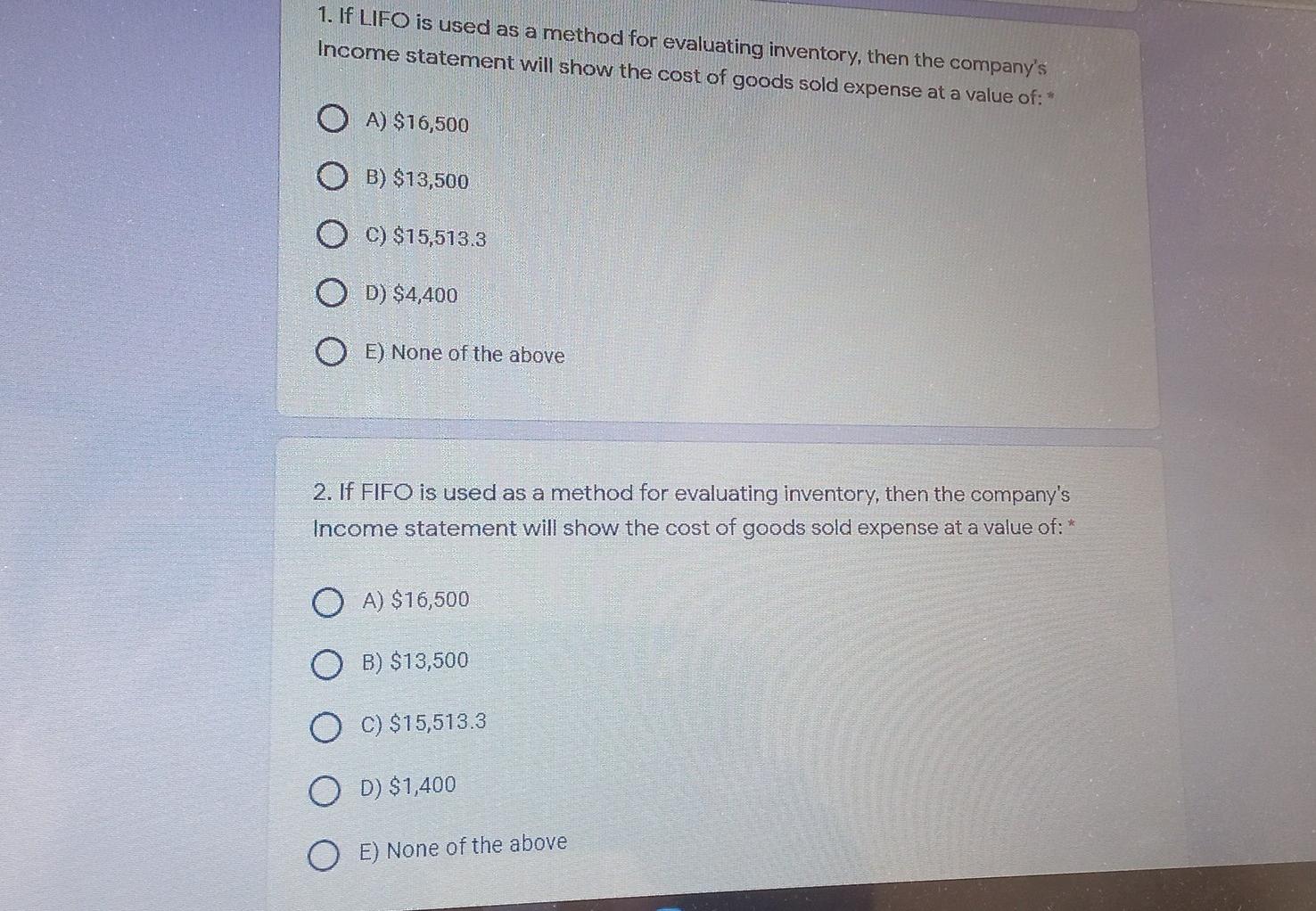

Problem 1: Arington Tech Company, sells electronics in Chicago - USA, It has the following data for its purchases for the first- semiannual of 2020. Units Cost per unit Selling price per unit Inventory Beginning inventory Jan 1 300 22 1 Feb Purchase 100 14 150 26 Sales 15 March 200 12 Purchase II II I 1 April Purchase 400 10 25 July 20 --- Sales 550 5 Aug Purchase 500 7 15 Oct 21 --- Sales 600 25 Dec tony then the company's 1. If LIFO is used as a method for evaluating inventory, then the company's Income statement will show the cost of goods sold expense at a value of: O A) $16,500 O B) $13,500 O C) $15,513,3 OD) $4,400 OE) None of the above 2. If FIFO is used as a method for evaluating inventory, then the company's Income statement will show the cost of goods sold expense at a value of: * O A) $16,500 B) $13,500 O C) $15,513.3 O D) $1,400 OE) None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts