Question: Assume that after operations and partner's withdrawals during 2017 and 2018. DE partnership has a book value of P120,000, that is D, capital P72,000

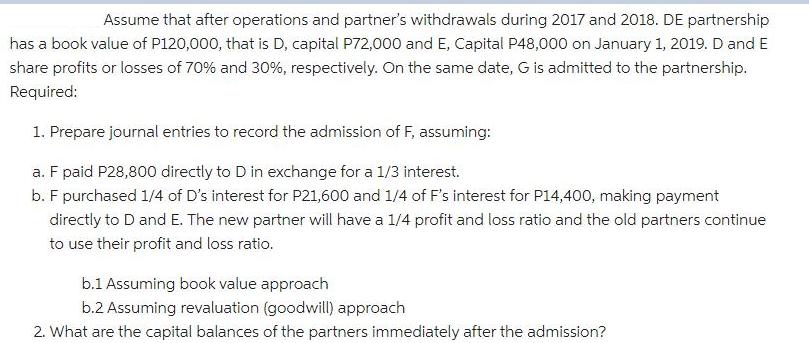

Assume that after operations and partner's withdrawals during 2017 and 2018. DE partnership has a book value of P120,000, that is D, capital P72,000 and E, Capital P48,000 on January 1, 2019. D and E share profits or losses of 70% and 30%, respectively. On the same date, G is admitted to the partnership. Required: 1. Prepare journal entries to record the admission of F, assuming: a. F paid P28,800 directly to D in exchange for a 1/3 interest. b. F purchased 1/4 of D's interest for P21,600 and 1/4 of F's interest for P14,400, making payment directly to D and E. The new partner will have a 1/4 profit and loss ratio and the old partners continue to use their profit and loss ratio. b.1 Assuming book value approach b.2 Assuming revaluation (goodwill) approach 2. What are the capital balances of the partners immediately after the admission?

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

1 SOLUTION Book value of DE Partnership P 120000 Capital balances as ... View full answer

Get step-by-step solutions from verified subject matter experts