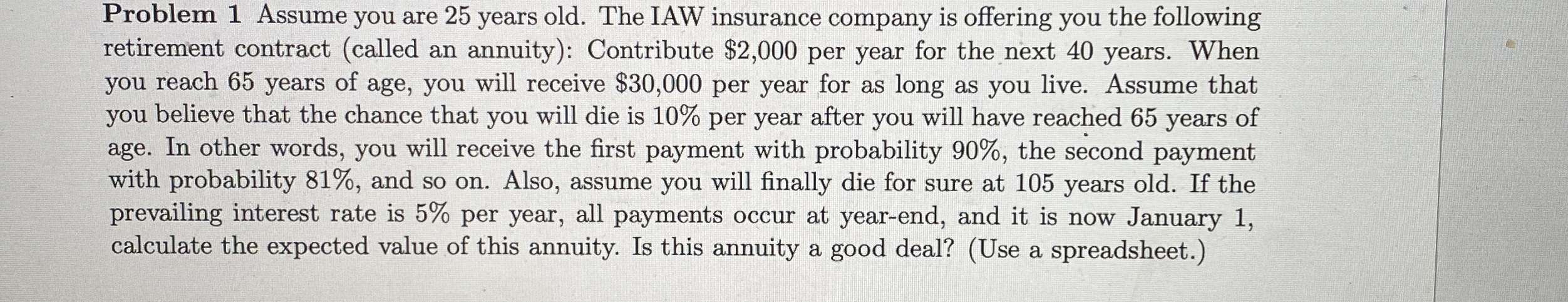

Question: Problem 1 Assume you are 2 5 years old. The IAW insurance company is offering you the following retirement contract ( called an annuity )

Problem Assume you are years old. The IAW insurance company is offering you the following

retirement contract called an annuity: Contribute $ per year for the next years. When

you reach years of age, you will receive $ per year for as long as you live. Assume that

you believe that the chance that you will die is per year after you will have reached years of

age. In other words, you will receive the first payment with probability the second payment

with probability and so on Also, assume you will finally die for sure at years old. If the

prevailing interest rate is per year, all payments occur at yearend, and it is now January

calculate the expected value of this annuity. Is this annuity a good deal? Use a spreadsheet.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock