Question: Problem 1 Assume you are considering 6 coupon bonds whose investment characteristics are given in the table below: begin { tabular } { |

Problem

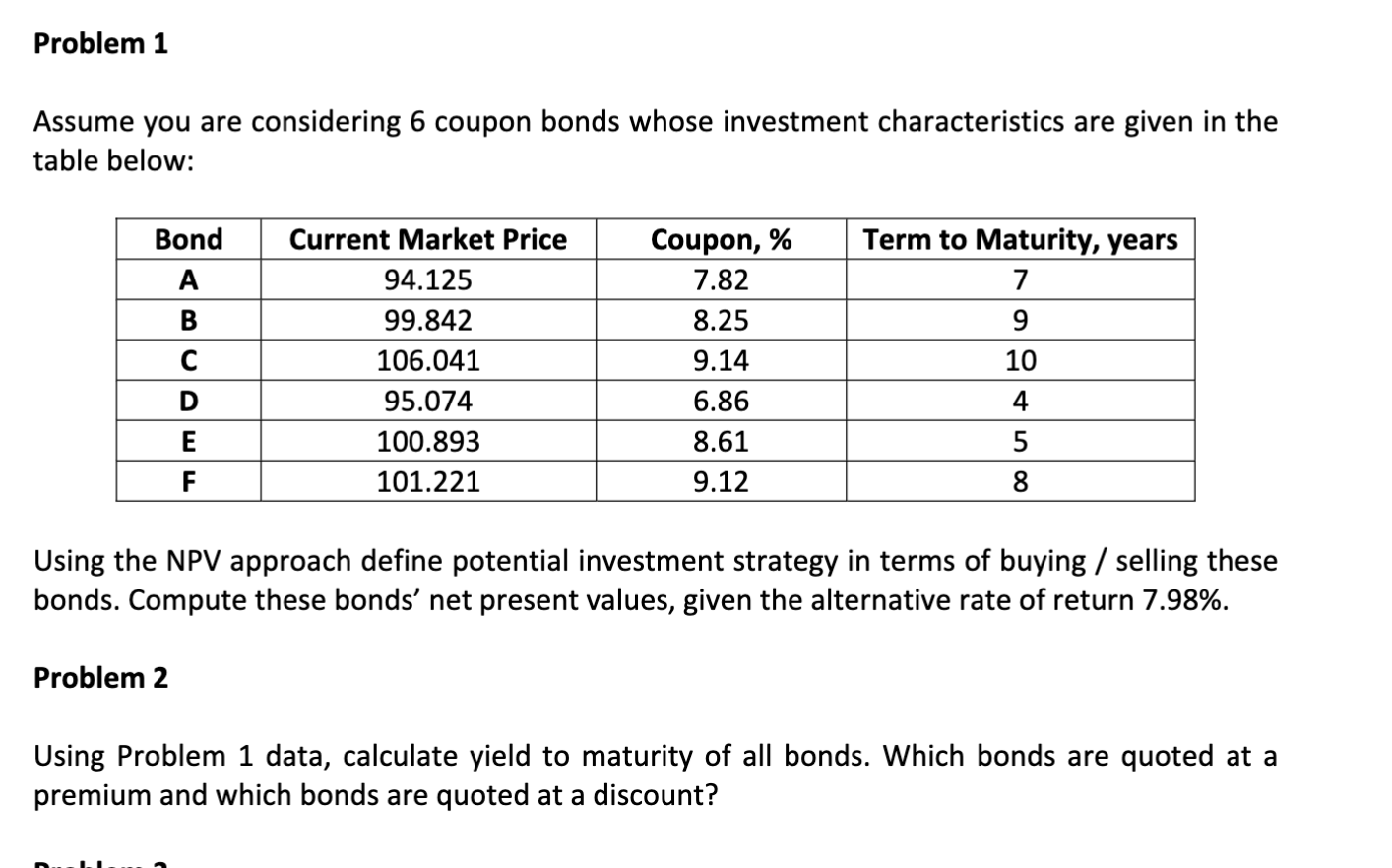

Assume you are considering coupon bonds whose investment characteristics are given in the table below:

begintabularcccc

hline Bond & Current Market Price & Coupon, & Term to Maturity, years

hline A & & &

hline B & & &

hline C & & &

hline D & & &

hline E & & &

hline F & & &

hline

endtabular

Using the NPV approach define potential investment strategy in terms of buying selling these bonds. Compute these bonds' net present values, given the alternative rate of return

Problem

Using Problem data, calculate yield to maturity of all bonds. Which bonds are quoted at a premium and which bonds are quoted at a discount?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock