Question: Problem 1: Based on the balance sheet and income statement below, calculate the ROA, ROE, and rate sensitivity gap for each question below. For each

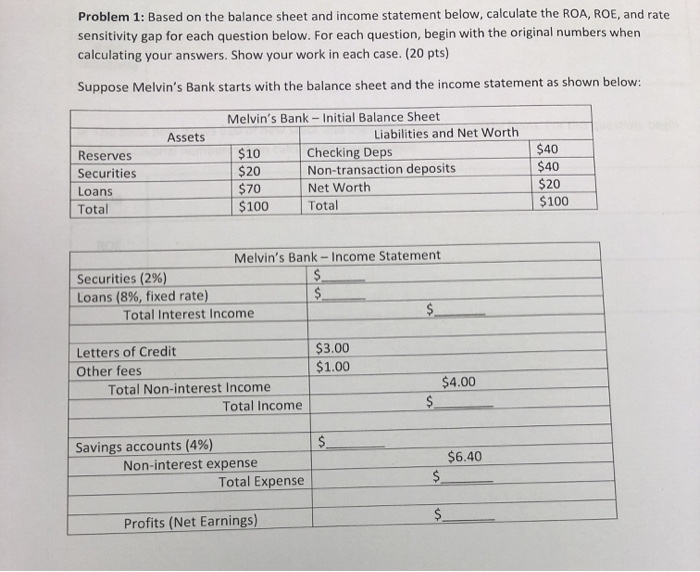

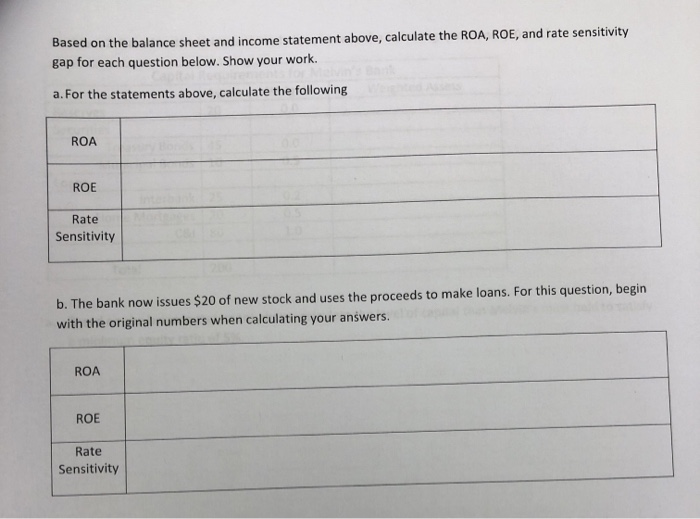

Problem 1: Based on the balance sheet and income statement below, calculate the ROA, ROE, and rate sensitivity gap for each question below. For each question, begin with the original numbers when calculating your answers. Show your work in each case. (20 pts) Suppose Melvin's Bank starts with the balance sheet and the income statement as shown below: Assets $40 Melvin's Bank - Initial Balance Sheet Liabilities and Net Worth $10 Checking Deps $20 Non-transaction deposits $70 Net Worth $100 Total Reserves Securities Loans Total $40 $20 $100 Melvin's Bank-Income Statement Securities (2%) Loans (8%, fixed rate) Total Interest Income $3.00 $1.00 Letters of Credit Other fees Total Non-interest Income Total Income $4.00 $6.40 Savings accounts (4%) Non-interest expense Total Expense Profits (Net Earnings) Based on the balance sheet and income statement above, calculate the ROA, ROE, and rate sensitivity gap for each question below. Show your work. a. For the statements above, calculate the following ROA ROE Rate Sensitivity b. The bank now issues $20 of new stock and uses the proceeds to make loans. For this question, begin with the original numbers when calculating your answers. ROA ROE Rate Sensitivity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts