Question: Problem #1: Based on the information (pdf file) provided on Nominaland Effective Interest rates, a) State which type of interest rate you would prefer if

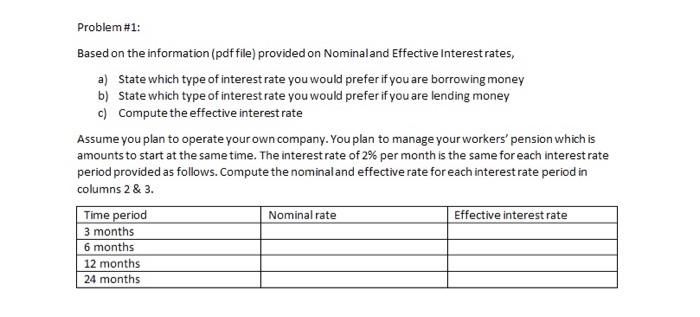

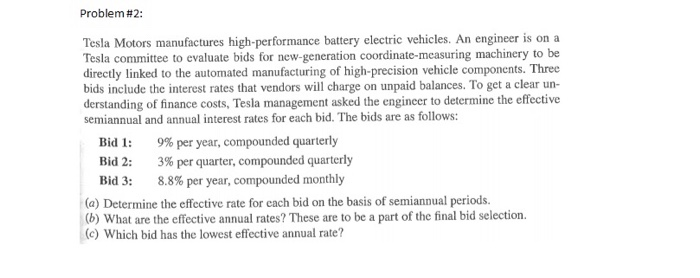

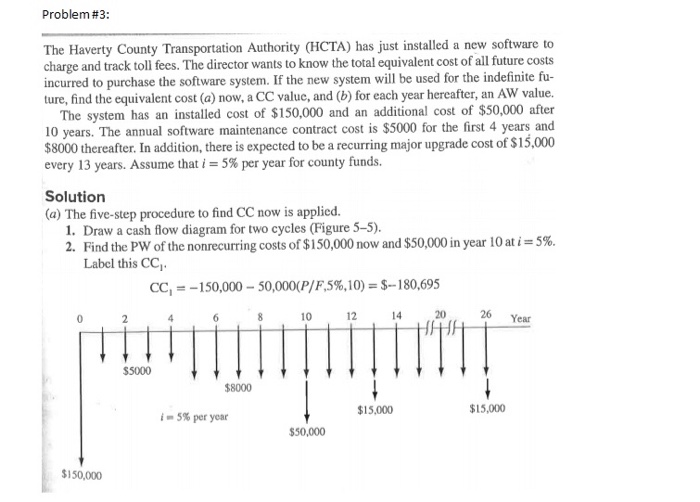

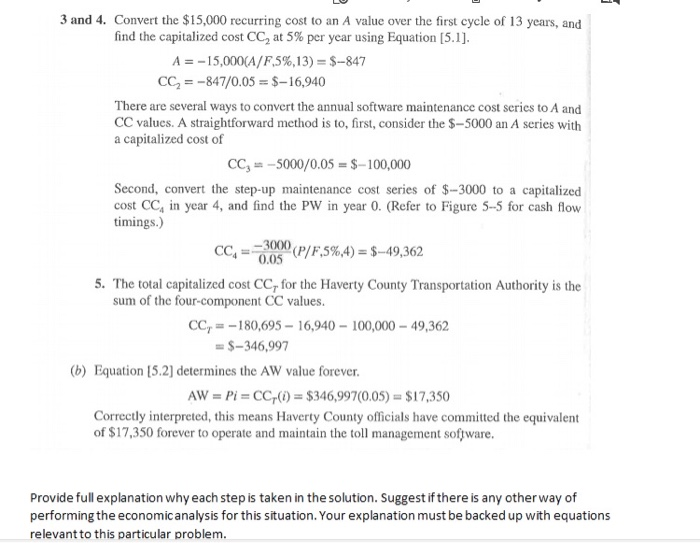

Problem #1: Based on the information (pdf file) provided on Nominaland Effective Interest rates, a) State which type of interest rate you would prefer if you are borrowing money b) State which type of interest rate you would prefer if you are lending money c) Compute the effective interest rate Assume you plan to operate your own company. You plan to manage your workers' pension which is amounts to start at the same time. The interest rate of 2% per month is the same for each interest rate period provided as follows. Compute the nominal and effective rate for each interest rate period in columns 2 & 3. Time period Nominal rate Effective interest rate 3 months 6 months 12 months 24 months Problem #2: Tesla Motors manufactures high-performance battery electric vehicles. An engineer is on a Tesla committee to evaluate bids for new-generation coordinate-measuring machinery to be directly linked to the automated manufacturing of high-precision vehicle components. Three bids include the interest rates that vendors will charge on unpaid balances. To get a clear un- derstanding of finance costs, Tesla management asked the engineer to determine the effective semiannual and annual interest rates for each bid. The bids are as follows: Bid 1: 9% per year, compounded quarterly Bid 2: 3% per quarter, compounded quarterly Bid 3: 8.8% per year, compounded monthly (a) Determine the effective rate for cach bid on the basis of semiannual periods. (b) What are the effective annual rates? These are to be a part of the final bid selection. (c) Which bid has the lowest effective annual rate? Problem #3: The Haverty County Transportation Authority (HCTA) has just installed a new software to charge and track toll fees. The director wants to know the total equivalent cost of all future costs incurred to purchase the software system. If the new system will be used for the indefinite fu- ture, find the equivalent cost (a) now, a CC value, and (b) for each year hereafter, an AW value. The system has an installed cost of $150,000 and an additional cost of $50,000 after 10 years. The annual software maintenance contract cost is $5000 for the first 4 years and $8000 thereafter. In addition, there is expected to be a recurring major upgrade cost of $15,000 every 13 years. Assume that i = 5% per year for county funds. Solution (a) The five-step procedure to find CC now is applied. 1. Draw a cash flow diagram for two cycles (Figure 5-5). 2. Find the PW of the nonrecurring costs of $150,000 now and $50,000 in year 10 at i= 5%. Label this CC, CC, - -150,000 - 50,000(P/F,5%,10) = S--180,695 10 12 14 26 Year HAT 20 $5000 $8000 - 5% per year $15,000 $15,000 $50,000 $150,000 11 3 and 4. Convert the $15,000 recurring cost to an A value over the first cycle of 13 years, and find the capitalized cost CC at 5% per year using Equation (5.1). A = -15,000(A/F,5%,13) = $-847 CC = -847/0.05 = $-16,940 There are several ways to convert the annual software maintenance cost series to A and CC values. A straightforward method is to, first, consider the $-5000 an A series with a capitalized cost of CC= -5000/0.05 = $ 100,000 Second, convert the step-up maintenance cost series of $-3000 to a capitalized cost CC, in year 4, and find the PW in year 0. (Refer to Figure 5-5 for cash flow timings.) CC (P/F,5%,4)= $-49,362 0.05 5. The total capitalized cost CC, for the Haverty County Transportation Authority is the sum of the four-component CC values. CC, = -180,695 - 16,940 - 100,000 - 49,362 = $-346,997 (b) Equation (5.2) determines the AW value forever. AW = Pi=CC() = $346,997(0.05) = $17,350 Correctly interpreted, this means Haverty County officials have committed the equivalent of $17,350 forever to operate and maintain the toll management software. 3000 Provide full explanation why each step is taken in the solution. Suggest if there is any other way of performing the economic analysis for this situation. Your explanation must be backed up with equations relevant to this particular

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts