Question: Problem 1 Bentley Corp. and Rolls Manufacturing are considering a merger. The possible states of the economy and each company's value in the state are

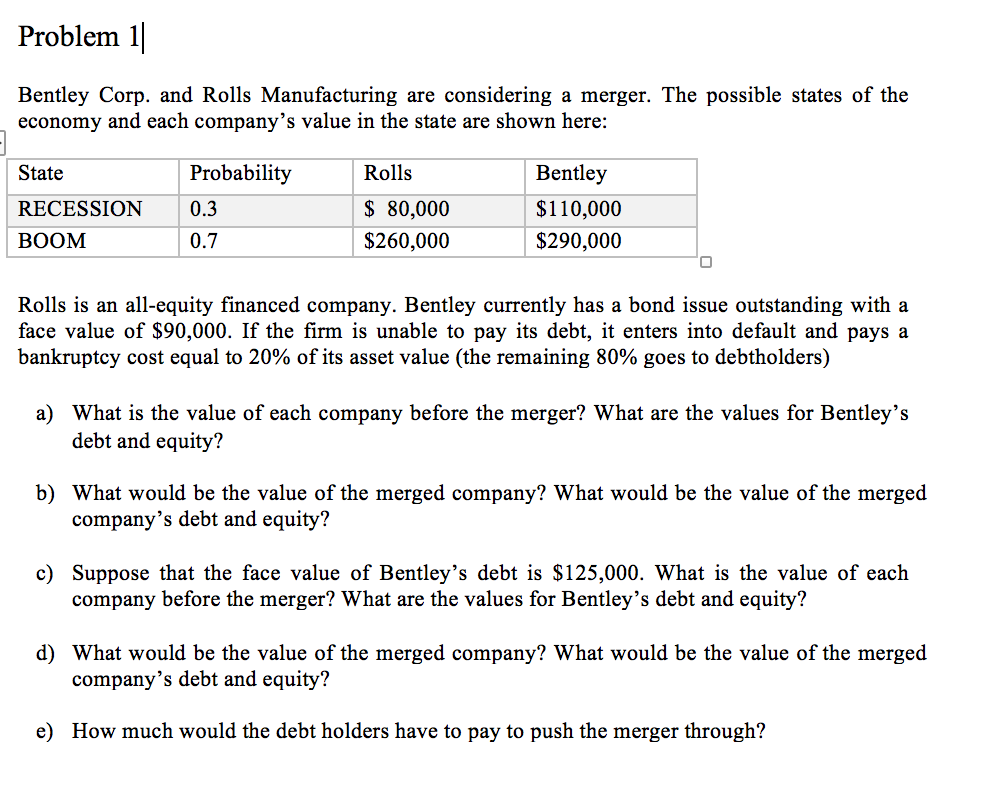

Problem 1 Bentley Corp. and Rolls Manufacturing are considering a merger. The possible states of the economy and each company's value in the state are shown here: State RECESSION0.3 BOOM Probability Rolls $ 80,000 $260,000 Bentley $110,000 $290,000 0.7 Rolls is an all-equity financed company. Bentley currently has a bond issue outstanding with a face value of $90,000. If the firm is unable to pay its debt, it enters into default and pays a bankruptcy cost equal to 20% of its asset value (the remaining 80% goes to debtholders) a) What is the value of each company before the merger? What are the values for Bentley's debt and equity? b) What would be the value of the merged company? What would be the value of the merged company's debt and equity? c) Suppose that the face value of Bentley's debt is $125,000. What is the value of each company before the merger? What are the values for Bentley's debt and equity? d) What would be the value of the merged company? What would be the value of the merged company's debt and equity? How much would the debt holders have to pay to push the merger through? e) Problem 1 Bentley Corp. and Rolls Manufacturing are considering a merger. The possible states of the economy and each company's value in the state are shown here: State RECESSION0.3 BOOM Probability Rolls $ 80,000 $260,000 Bentley $110,000 $290,000 0.7 Rolls is an all-equity financed company. Bentley currently has a bond issue outstanding with a face value of $90,000. If the firm is unable to pay its debt, it enters into default and pays a bankruptcy cost equal to 20% of its asset value (the remaining 80% goes to debtholders) a) What is the value of each company before the merger? What are the values for Bentley's debt and equity? b) What would be the value of the merged company? What would be the value of the merged company's debt and equity? c) Suppose that the face value of Bentley's debt is $125,000. What is the value of each company before the merger? What are the values for Bentley's debt and equity? d) What would be the value of the merged company? What would be the value of the merged company's debt and equity? How much would the debt holders have to pay to push the merger through? e)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts