Question: Problem 1. (Black-Scholes formula, 15') Use the Black-Scholes formula for calculations and show your steps. When evaluating N(z), use the values in the attached N(z)

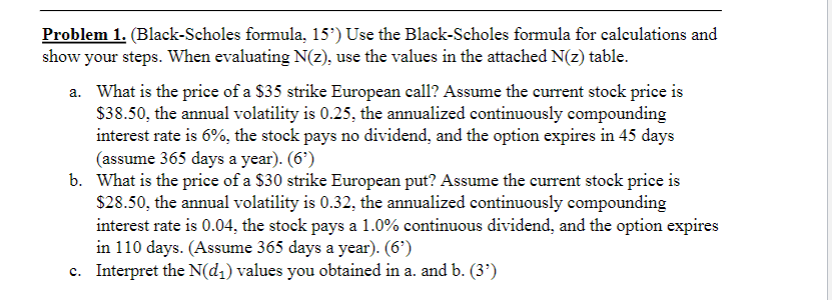

Problem 1. (Black-Scholes formula, 15') Use the Black-Scholes formula for calculations and show your steps. When evaluating N(z), use the values in the attached N(z) table. a. What is the price of a $35 strike European call? Assume the current stock price is $38.50, the annual volatility is 0.25, the annualized continuously compounding interest rate is 6%, the stock pays no dividend, and the option expires in 45 days (assume 365 days a year). ( 6 ) b. What is the price of a $30 strike European put? Assume the current stock price is $28.50, the annual volatility is 0.32, the annualized continuously compounding interest rate is 0.04, the stock pays a 1.0% continuous dividend, and the option expires in 110 days. (Assume 365 days a year). (6') c. Interpret the N(d1) values you obtained in a. and b. ( 3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts