Question: Problem 1 ( Break - even Analysis ) 2 5 pts A state highway department is planning the construction of a toll road. Construction cost

Problem Breakeven Analysis

pts

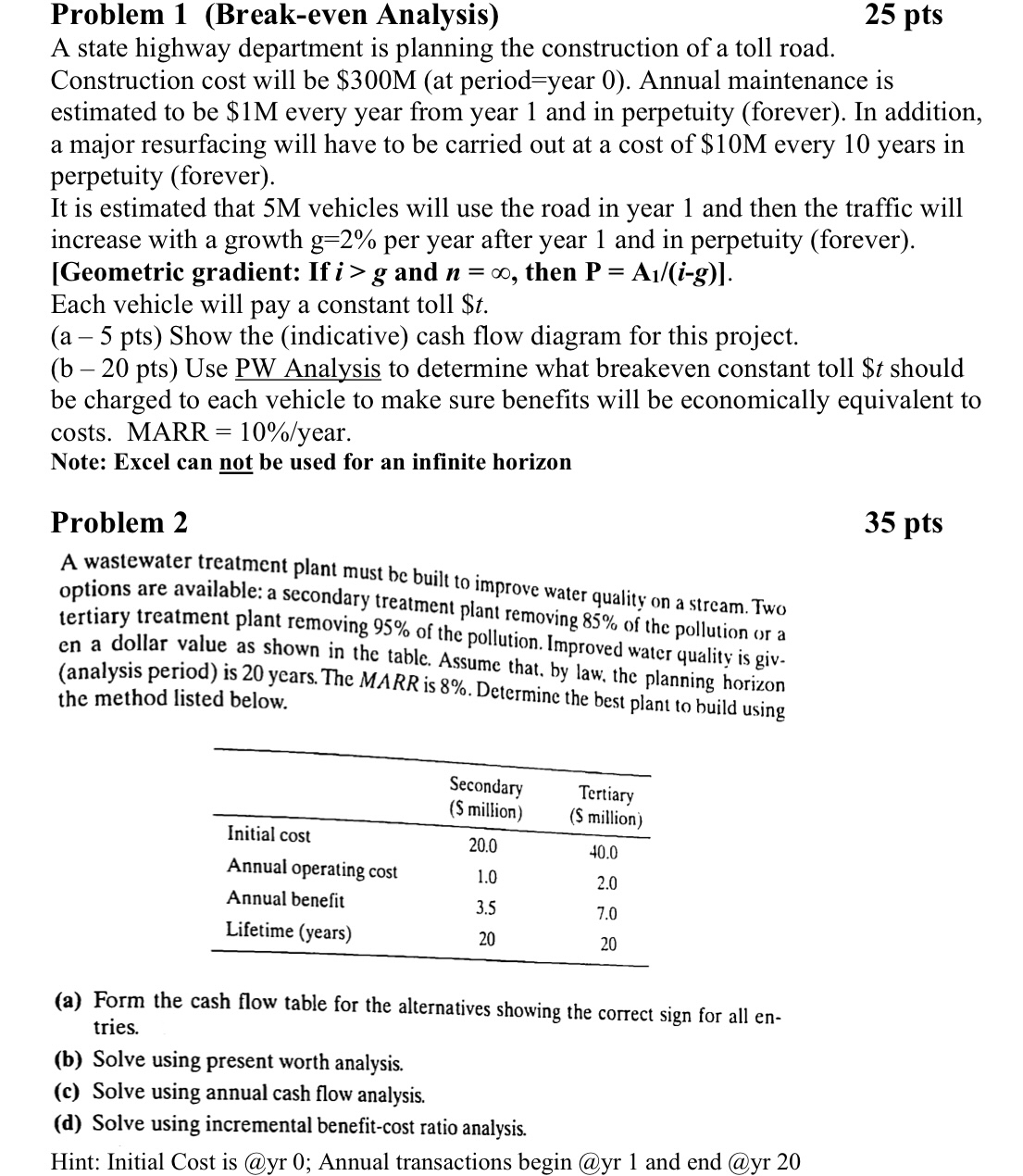

A state highway department is planning the construction of a toll road. Construction cost will be $at periodyear Annual maintenance is estimated to be $ every year from year and in perpetuity forever In addition, a major resurfacing will have to be carried out at a cost of $ every years in perpetuity forever

It is estimated that M vehicles will use the road in year and then the traffic will increase with a growth per year after year and in perpetuity forever

Geometric gradient: If and then

Each vehicle will pay a constant toll $

Show the indicative cash flow diagram for this project.

b pts Use PW Analysis to determine what breakeven constant toll $ should be charged to each vehicle to make sure benefits will be economically equivalent to costs. MARR year.

Note: Excel can not be used for an infinite horizon

Problem

pts

A wastewater treatment plant must be built to improve water quality on a stream. Two options are available: a secondary treatment plant removing of the pollution or a tertiary treatment plant removing of the pollution. Improved water quality is given a dollar value as shown in the table. Assume that, by law, the planning horizon analysis period is years. The MARR is Determine the best plant to build using the method listed below.

tabletableSecondary $ milliontableTertiary millionInitial costAnnual operating cost,Annual benefit,Lifetime years

a Form the cash flow table for the alternatives showing the correct sign for all entries.

b Solve using present worth analysis.

c Solve using annual cash flow analysis.

d Solve using incremental benefitcost ratio analysis.

Hint: Initial Cost is@yr ; Annual transactions begin@yr and end @yr

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock