Question: Problem #1 Buildagood Ltd. began the process of self-constructing an office building in 2021. In order to provide for partial financing of the total construction

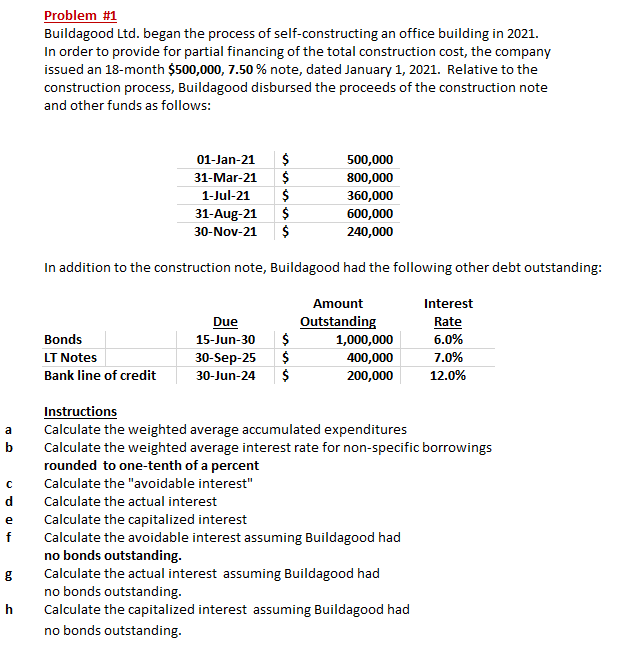

Problem #1 Buildagood Ltd. began the process of self-constructing an office building in 2021. In order to provide for partial financing of the total construction cost, the company issued an 18-month $500,000, 7.50 % note, dated January 1, 2021. Relative to the construction process, Buildagood disbursed the proceeds of the construction note and other funds as follows: 01-Jan-21 31-Mar-21 1-Jul-21 31-Aug-21 30-Nov-21 $ $ $ $ $ 500,000 800,000 360,000 600,000 240,000 In addition to the construction note, Buildagood had the following other debt outstanding: Due Bonds LT Notes Bank line of credit 15-Jun-30 30-Sep-25 30-Jun-24 $ $ $ Amount Outstanding 1,000,000 400,000 200,000 Interest Rate 6.0% 7.0% 12.0% a b c d e f Instructions Calculate the weighted average accumulated expenditures Calculate the weighted average interest rate for non-specific borrowings rounded to one-tenth of a percent Calculate the "avoidable interest" Calculate the actual interest Calculate the capitalized interest Calculate the avoidable interest assuming Buildagood had no bonds outstanding. Calculate the actual interest assuming Buildagood had no bonds outstanding. Calculate the capitalized interest assuming Buildagood had no bonds outstanding. 8 h

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts