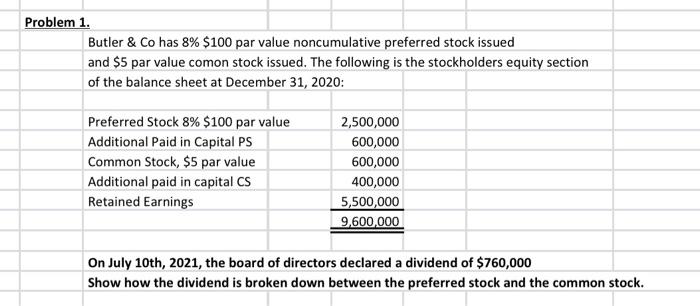

Question: Problem 1. Butler & Co has 8%$100 par value noncumulative preferred stock issued and $5 par value comon stock issued. The following is the stockholders

Problem 1. Butler \& Co has 8%$100 par value noncumulative preferred stock issued and $5 par value comon stock issued. The following is the stockholders equity section of the balance sheet at December 31, 2020: \begin{tabular}{|l|} \hline Preferred Stock 8%$100 par valual \\ \hline Additional Paid in Capital PS \\ \hline Common Stock, \$5 par value \\ \hline Additional paid in capital CS \\ \hline Retained Earnings \end{tabular} \begin{tabular}{|r|r|} \hline & \\ \hline alue & 2,500,000 \\ \hline 600,000 \\ \hline 600,000 \\ \hline & 400,000 \\ \hline 5,500,000 \\ \hline 9,600,000 \\ \hline \hline \end{tabular} On July 10th, 2021, the board of directors declared a dividend of $760,000 Show how the dividend is broken down between the preferred stock and the common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts