Question: Problem 1: Capacity (chapter 5) The table below shows projected demand for a new model of leather bag being produced by BrownBag, Inc. called BestBag

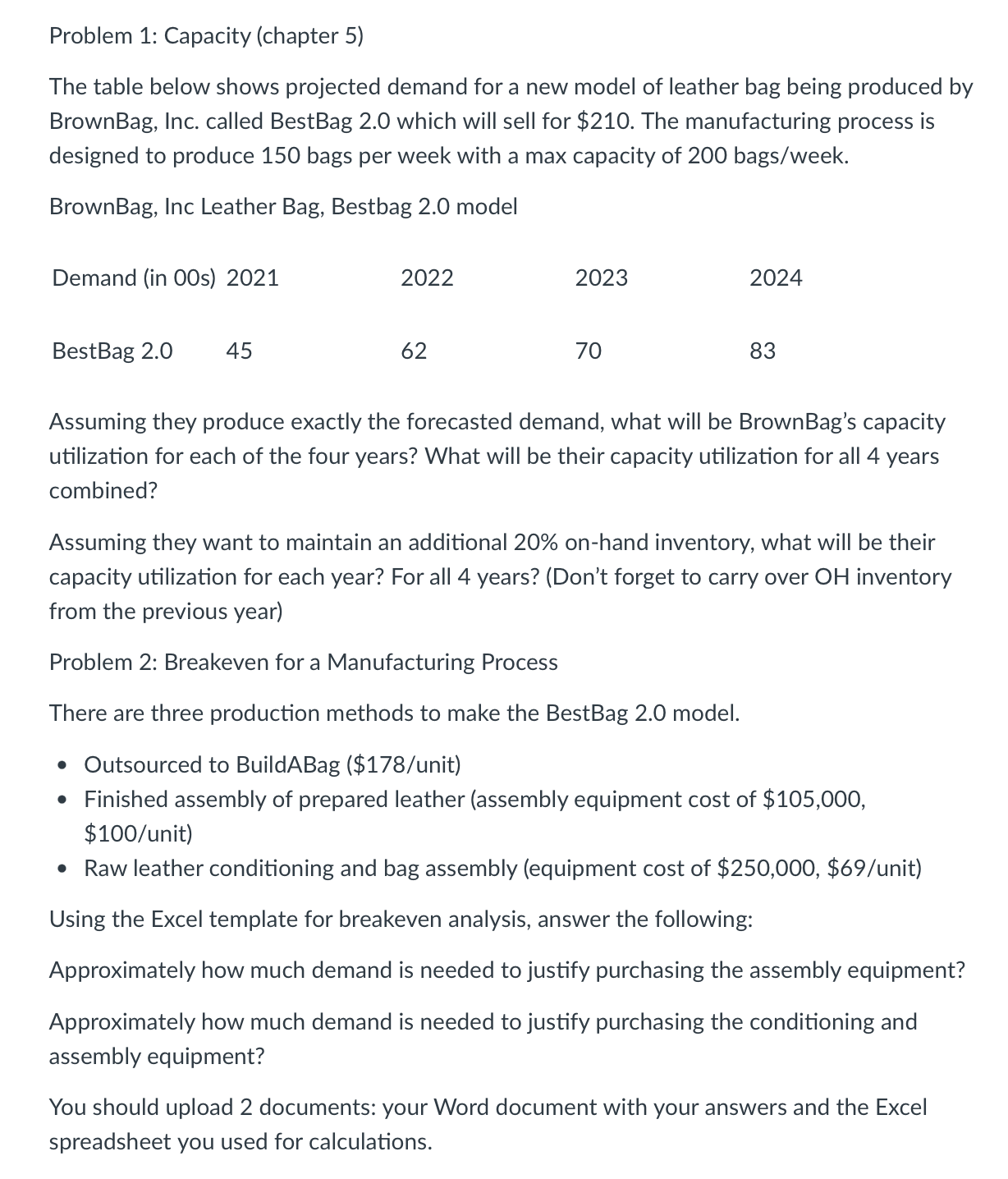

Problem 1: Capacity (chapter 5) The table below shows projected demand for a new model of leather bag being produced by BrownBag, Inc. called BestBag 2.0 which will sell for $210. The manufacturing process is designed to produce 150 bags per week with a max capacity of 200 bags/week. BrownBag, Inc Leather Bag, Bestbag 2.0 model Assuming they produce exactly the forecasted demand, what will be BrownBag's capacity utilization for each of the four years? What will be their capacity utilization for all 4 years combined? Assuming they want to maintain an additional 20% on-hand inventory, what will be their capacity utilization for each year? For all 4 years? (Don't forget to carry over OH inventory from the previous year) Problem 2: Breakeven for a Manufacturing Process There are three production methods to make the BestBag 2.0 model. - Outsourced to BuildABag (\$178/unit) - Finished assembly of prepared leather (assembly equipment cost of $105,000, $100 /unit) - Raw leather conditioning and bag assembly (equipment cost of $250,000,$69/ unit) Using the Excel template for breakeven analysis, answer the following: Approximately how much demand is needed to justify purchasing the assembly equipment? Approximately how much demand is needed to justify purchasing the conditioning and assembly equipment? You should upload 2 documents: your Word document with your answers and the Excel spreadsheet you used for calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts