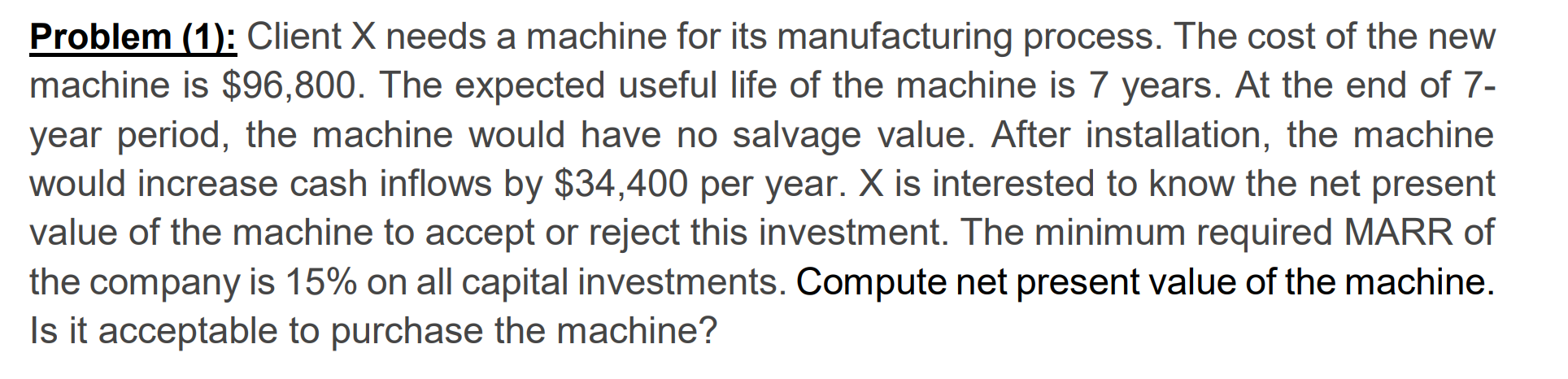

Question: Problem (1): Client X needs a machine for its manufacturing process. The cost of the new machine is $96,800. The expected useful life of the

Problem (1): Client X needs a machine for its manufacturing process. The cost of the new machine is $96,800. The expected useful life of the machine is 7 years. At the end of 7- year period, the machine would have no salvage value. After installation, the machine would increase cash inflows by $34,400 per year. X is interested to know the net present value of the machine to accept or reject this investment. The minimum required MARR of the company is 15% on all capital investments. Compute net present value of the machine. Is it acceptable to purchase the machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts