Question: Problem 1: Consider a $1000 bond with a coupon rate of 10% and annual coupons. The par value is $1,000, and the bond has 5

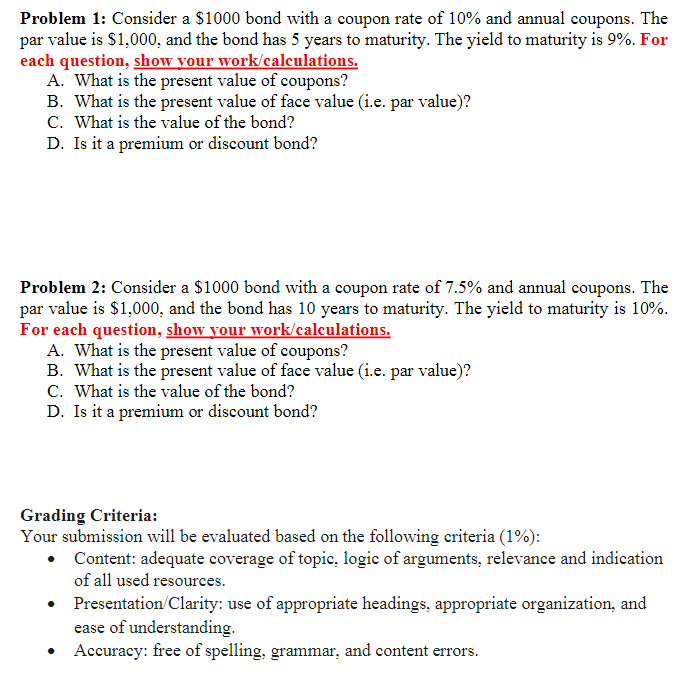

Problem 1: Consider a $1000 bond with a coupon rate of 10% and annual coupons. The par value is $1,000, and the bond has 5 years to maturity. The yield to maturity is 9%. For each question, show your work/calculations. A. What is the present value of coupons? B. What is the present value of face value (i.e. par value)? C. What is the value of the bond? D. Is it a premium or discount bond? Problem 2: Consider a $1000 bond with a coupon rate of 7.5% and annual coupons. The par value is $1,000, and the bond has 10 years to maturity. The yield to maturity is 10%. For each question, show your work/calculations. A. What is the present value of coupons? B. What is the present value of face value (i.e. par value)? C. What is the value of the bond? D. Is it a premium or discount bond? Grading Criteria: Your submission will be evaluated based on the following criteria (1%): Content: adequate coverage of topic, logic of arguments, relevance and indication of all used resources. Presentation Clarity: use of appropriate headings, appropriate organization, and ease of understanding Accuracy: free of spelling, grammar, and content errors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts